Consumer price inflation is above pre-pandemic trend in the United States and Europe, while producer prices are surging seemingly everywhere. Consistent with consensus forecasts, we expect mounting inflation pressures to ease by second half 2022 as demand for goods abates and supply constraints moderate.

Excess inflation is the result of severe supply and demand imbalances, largely driven by extraordinary fiscal and monetary policies that boosted demand amid pandemic-related supply constraints. The composition of consumer spending also shifted from services to goods. Demand for goods has been running above pre-COVID-19 levels, which has strained supply chains. Input costs have also surged amid elevated commodity prices. Coal and natural gas shortages in China and Europe, respectively, created an energy crisis. Energy prices have declined sharply after peaking in October but remain historically expensive.

In 2022, we expect demand for goods to soften as growth slows—due to waning effects from fiscal stimulus and gradual tightening of monetary policy—and consumer spending shifts back to services amid rising vaccination levels and new COVID-19 treatments. Meanwhile, the supply of goods should improve for several reasons. First, manufacturers have increased the use of existing capacity to meet demand. Next, energy costs are likely to continue declining with additional supplies of natural gas and coal coming online. Finally, tight labor markets should ease as financial cushions built up since 2020 are spent down and virus concerns fade.

Though we expect inflation to moderate, it is unlikely to fully revert to pre-pandemic trend in 2022 given some more persistent supply constraints, such as the semiconductor shortage, port congestion, and skill mismatches in the labor force. Near-term risks skew to the upside; tighter-than-expected labor markets or a re-imposition of COVID-19 restrictions could lead to stickier inflation, prompting central banks to tighten more than currently expected. Over the longer term, secular forces such as decarbonization and onshoring could also put upward pressure on prices.

Despite elevated uncertainty, we believe goods demand normalization combined with near-term supply improvement will help inflationary pressures ease by the end of 2022.

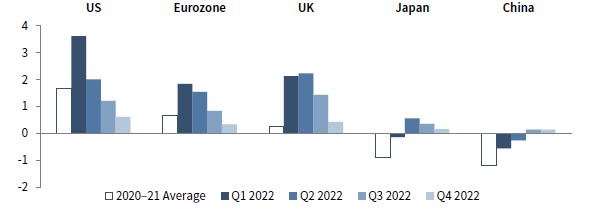

INFLATIONARY PRESSURES MOUNTING BUT EXPECTED TO PEAK IN 2022

As of November 30, 2021 • Expected Difference in Inflation Rates from Pre-Pandemic Trend (Percentage Points)

Sources: Bloomberg L.P. and Thomson Reuters Datastream.

Notes: The 2020–21 average is based on actual data through October 2021 and interpolated through December 2021 based on forecasted 4Q2021 levels. Forecasts are based on Bloomberg consensus estimates. Pre-pandemic trend growth is based on trend-line inflation from April 2015 through December 2019.

Joe Comras, Associate Investment Director, Investment Strategy