Climate Tech’s Evolution: The Maturation to a Competitive, Returns-Focused Thematic Investment Sector

Climate technologies (climate tech) have gained popularity among investors in recent years. These technologies encompass a broad set of assets that seek to provide solutions to the challenges associated with climate change. Such assets often include contribution to decarbonization of the global economy and incorporate investment themes such as the energy transition, sustainable food systems, clean transportation, efficient buildings (i.e., the built environment), and heavy industry disruption. To those familiar with the space, climate tech is neither new nor a trend, but rather an evolution from the clean technology (clean tech) solutions developed in the 2000s. In this paper, we explore the development of this growing investment theme—specifically in private equity and venture capital—and its evolution into a financially compelling investment opportunity. In addition, we discuss how we believe investors can best take advantage of this opportunity.

Clean Tech 1.0

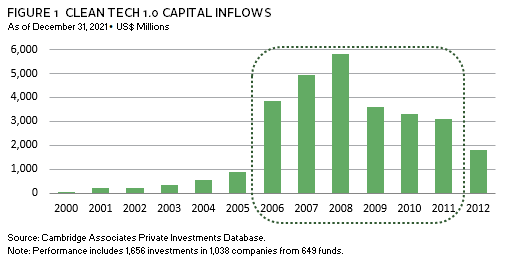

The first wave of climate technology investing (Clean Tech 1.0) began in the early 2000s as Silicon Valley venture capital (VC) firms marched into the sector with more enthusiasm than experience. These clean tech pioneers were propelled by a growing awareness of the urgency behind climate change, following public campaigns from prominent advocates including former US Vice President Al Gore and venture capitalist John Doerr. The demand for positive environmental impact coincided with compelling market opportunities driven by historically high energy prices and favorable government subsidies. Between 2006 and 2011, we estimate that investors poured approximately $25 billion into clean tech companies (Figure 1).

Much of this enthusiasm and interest was driven by generalist investors who entered the market without fully comprehending the technical risks, capital intensity, and extended timelines of these early clean tech investments. They poured capital into the asset-heavy manufacturing and development of, at the time, unproven and expensive sectors such as solar, wind, biofuels, and fuel cells.

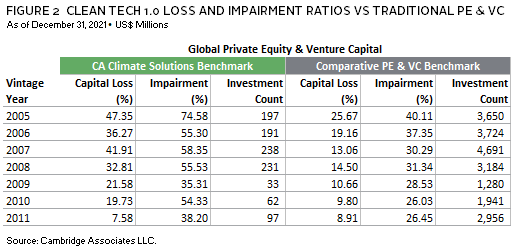

For a variety of reasons, this first wave of funds would ultimately generate poor performance. In addition to a lack of understanding of technical risks, investors were not equipped to support their capital-intensive portfolio companies that needed capital to build scalable manufacturing facilities. Finally, the industry faced economic challenges brought on by the 2008 Global Financial Crisis, low energy prices propelled by advancements in hydraulic fracturing, and the glut of cheap solar panels from China. It is estimated that nearly half of the $25 billion capital invested by funds formed between 2006 and 2011 was either lost or impaired (Figure 2). 1 Some of the well documented clean tech company busts included Solyndra, Evergreen, EPV, SpectraWatt, and Sterling Energy.

The Emergence (and Promise) of Climate Tech 2.0

Out of the ashes of Clean Tech 1.0 emerged an evolved class of investors, armed with lessons learned and relevant operating expertise. Today, clean tech investors are supported by a network of climate tech peers across asset classes and investment stages; many are specialists who cut their teeth as investors or operators during Clean Tech 1.0. The field is not only dominated by venture capitalists providing catalytic capital to emerging technologies, but also encompasses growth equity investors with capital and expertise to scale commercially viable technologies, as well as real asset investors with the ability to deploy and use these technologies at scale in real world projects. Late-stage private equity managers are raising record capital with the ability to sustain the climate tech space beyond venture, unlike Clean Tech 1.0. In addition, sustainable infrastructure managers have ramped up to provide critical and compellingly structured capital for projects and companies that in Clean Tech 1.0 were otherwise funded by inexperienced venture capitalists. This league of climate tech investors provides an opportunity for asset owners to build a balanced portfolio of climate tech investments across stage and asset class.

From a sector expertise perspective, these Climate Tech 2.0 investors have taken a more measured approach to technology risk with more emphasis on software and optimization solutions, which are easier to scale and less capital intensive than hardware (e.g., carbon capture, fusion energy, hydrogen, etc.)—the primary focus of Clean Tech 1.0. While climate tech software presents competitive investment opportunities, hardware technologies are a crucial component in accelerating global decarbonization. Once de-risked, the surviving late-stage climate tech hardware companies face significant barriers to entry. Therefore, catalytic mission-aligned investors, as well as select sector specialists continue to fill the gaps by investing in necessary hardware technologies. In addition, strategic corporate investors are joining forces with traditional investment managers to invest in climate tech companies and add valuable technical and sector expertise as active board members as their own business models evolve with the energy transition.

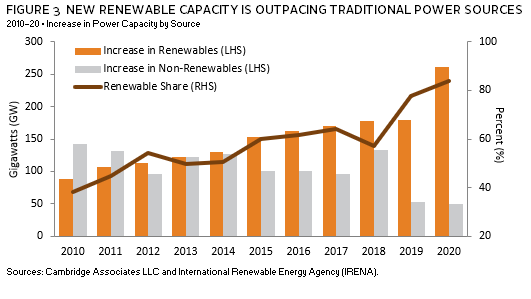

On top of this more robust network of investors, Climate Tech 2.0 appears to be benefiting from multiple macro factors. One of the most significant of these factors is the drastic decline in the cost of renewables and batteries, 2 which is enabling the energy transition at a speed and scale that was not achievable during Clean Tech 1.0. The cost decline in renewables has been so dramatic that solar and wind are frequently cheaper than fossil fuels in many locations. This has resulted in new capacity in renewable energy outpacing traditional power sources (Figure 3), a trend that is likely to continue to accelerate. Tangential technology cost declines across a variety of areas—such as sensors, hardware inputs, general business start-up costs—and the adoption of information technology and software have all benefited Climate Tech 2.0, as it has for other start-up sectors of the economy. All of these technology cost declines have significantly improved the unit economics of many Climate Tech 2.0 business models and have helped climate tech start-ups compete with the traditional industries they are attempting to disrupt.

Meanwhile on the policy side, public support—backed by concrete net zero commitments from governments and corporations alike—is at an all-time high 3 and is creating the demand for fast and scalable climate tech solutions. For example, the US Inflation Reduction Act of 2022 will increase US government climate spending by $369 billion. 4 Together with the CHIPS and Science Act and Infrastructure Investment and Jobs Act, US policy spending on climate will be over twice as much in the next five years as it was during Clean Tech 1.0. 5 Outside of the United States, the European Union has pledged over 30% of its budget, roughly $633 billion, on climate-related spending through 2027. This policy support is likely to continue to strengthen as rising geopolitical risks heighten the demand for energy independence and security.

Finally, not to be understated, is the talent migration to climate tech companies. As public concern over the climate crisis has grown, so too have individuals’ desires to work in climate careers. For example, according to some surveys, 40% of business school students across the globe want to pursue careers in environmental sustainability. 6

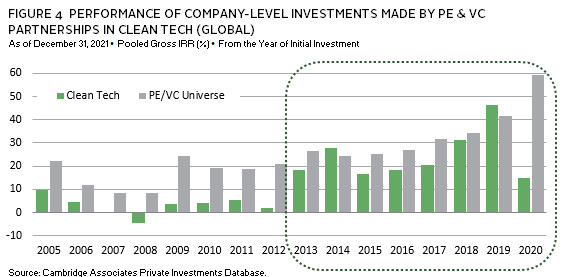

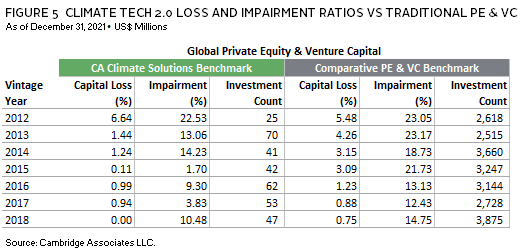

As a result of these momentous shifts, climate tech investment performance appears to be improving and is now comparable to the broader private equity and venture capital universe (Figure 4). Early data on capital loss and impairment ratios provide additional evidence of performance parity with the broader private investment universe (Figure 5).

Climate Tech’s Moment: Here to Stay and Ready for Investment

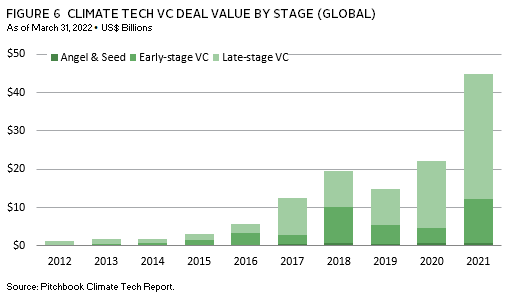

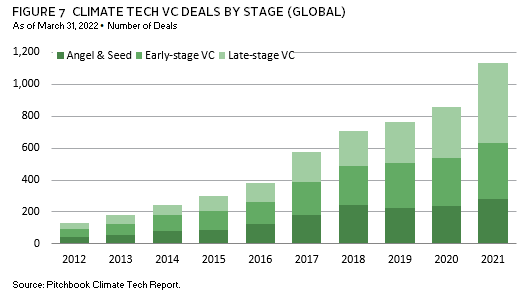

Today, capital flows into climate tech investing are growing again at record levels, from seed stage to growth equity. Across the venture landscape, climate tech attracted almost $45 billion in inflows in 2021, more than doubling that in 2020 (Figure 6). According to a recent PricewaterhouseCoopers (PwC) report, climate tech accounted for more than a quarter of every venture dollar in the 12 months prior to September 2022. 7

With this flood of capital, the average deal size nearly quadrupled in the first half of 2021 from the prior year, growing from $27 million to $96 million. Megadeals are becoming increasingly common and are driving much of the recent topline fund investment growth in climate tech. The United States remains dominant, closing more deals than any other region. Notable recent rounds include the $2 billion fundraise for autonomous driving company Cruise with both capital from and strategic partnerships with a consortium of investors including Microsoft, General Motors, and Honda. The transaction valued the company at $30 billion. In early-stage venture, valuations were equally heady as companies such as Electric Hydrogen—a company seeking to decarbonize industry and energy—raised $24 million in its Series A round led by Capricorn Technology Impact Fund, Prelude Ventures, and Breakthrough Ventures.

As we look to the coming years, climate tech is steadily maturing as an industry with the opportunity to generate outsized environmental impact and returns that are competitive with traditional investing. As noted earlier, unprecedented demand for lower-carbon technologies from net zero commitments across governments and corporations; record levels of policy support spending; lower than ever renewable energy, battery, and other technology costs; talent migration from traditional industries to sustainability; and an investor base with experience and capital that spans across all stages of the investment cycle, suggest that climate tech is here to stay, and that recent strong performance won’t be an anomaly.

The maturation and growth of the field, however, does not come without challenges. Valuations across public and private markets have reached, in some cases, previously unseen heights and have only recently begun to come back down to earth. In 2022, we have seen technology stock prices, including climate tech SPACs, decline significantly as the Federal Reserve accelerated interest rates rises. Meanwhile, the threat of green washing has become more prominent as fund managers seek to take advantage of limited partners’ increasing interest in the space.

While these challenges are notable, investors in Climate Tech 2.0—with prudent manager selection and lessons learned from Clean Tech 1.0—should be able to weather such challenges and generate returns competitive with traditional private equity and venture capital. Competitive performance will not be true across the board as the challenges noted will stretch some poorly positioned managers, as was the case in Clean Tech 1.0. However, the wise investor will avoid such hurdles and seek to partner with investment managers with deep sector knowledge, strong technical capabilities, investment discipline, interdisciplinary talent, and unique value add. To best take advantage of this trend, as with other venture sectors such as IT or healthcare, investors should create a portfolio of managers tackling climate tech. We believe one investment is better than none, but a diversified portfolio of targeted climate bets would be even better. While encouraging climate tech performance results are early thus far, we believe that they should be here to stay.

Emily Kisak also contributed to the publication.

Figure Notes

FIGURE 2 CLEAN TECH 1.0 LOSS AND IMPAIRMENT RATIOS VS TRADITIONAL PE & VC

Performance reflects gross deal level returns from 2006 to 2011. These investments comprise all company-level investments made by private equity and venture capital partnerships assessed as eligible for the CA Climate Solutions Company Performance Statistics during these vintage years. Comparative PE & VC benchmark includes Global CA VC & PE benchmarks. As of December 31, 2021, Cambridge Associates (CA) screened over 111,000 investments held by over 8,900 funds to identify clean tech investments. CA includes companies and projects in the clean tech sector if they (1) develop non-fossil fuel energy sources, (2) promote industrial efficiency by conserving resources and replacing existing processes with less-polluting alternatives, (3) recycle waste efficiently, or (4) provide a product or service that creates an environmental improvement.

FIGURE 4 PERFORMANCE OF COMPANY-LEVEL INVESTMENTS MADE BY PE & VC PARTNERSHIPS IN CLEAN TECH (GLOBAL)

Notes: Performance includes 1,557 investments and reflects gross deal level returns from 2005 to 2020. These investments comprise all company-level investments made by private equity and venture capital partnerships assessed as eligible for the CA Climate Solutions Company Performance Statistics. As of December 31, 2021, Cambridge Associates (CA) screened over 111,000 investments held by over 8,900 funds to identify clean tech investments. CA includes companies and projects in the clean tech sector if they (1) develop non-fossil fuel energy sources, (2) promote industrial efficiency by conserving resources and replacing existing processes with less-polluting alternatives, (3) recycle waste efficiently, or (4) provide a product or service that creates an environmental improvement.

FIGURE 5 CLIMATE TECH 2.0 LOSS AND IMPAIRMENT RATIOS VS TRADITIONAL PE & VC

Performance reflects gross deal level returns from 2012 to 2018. Data either not significant enough nor mature enough for vintage years 2019–22. These investments comprise all company-level investments made by private equity and venture capital partnerships assessed as eligible for the CA Climate Solutions Company Performance Statistics. Comparative PE & VC benchmark includes Global CA VC & PE benchmarks. As of December 31, 2021, Cambridge Associates (CA) screened over 111,000 investments held by over 8,900 funds to identify clean tech investments. CA includes companies and projects in the clean tech sector if they (1) develop non-fossil fuel energy sources, (2) promote industrial efficiency by conserving resources and replacing existing processes with less-polluting alternatives, (3) recycle waste efficiently, or (4) provide a product or service that creates an environmental improvement.

Footnotes

- In this publication, the Cambridge Associates Clean Tech Company Performance Statistics is referred to as the Cambridge Associates Climate Solutions Benchmark” to reflect the eventual name change of this data source. “Climate Solutions” is more encompassing and more reflective of the evolving opportunity set than the current “Clean Tech” nomenclature. The name change will formally take place in 2023.

- International Renewable Energy Agency, “Renewable Power Generation Costs in 2020,” June 2021.

- Climate Action 100+ (March 2022), Net Zero Company Benchmark.

- Earthjustice, “What the Inflation Reduction Act Means for Climate,” August 2022.

- Lachlan Carey, Jun Ukita Shepard, “Congress’s Climate Triple Whammy: Innovation, Investment, and Industrial Policy,” Rocky Mountain Institute, August 22, 2022.

- Todd Cort et al., “Rising Leaders on Social and Environmental Sustainability: A Global Survey of Business Students (2022),” Yale Center for Business and the Environment, February 2022.

- Emma Cox, Will Jackson-Moore, Leo Johnson, and Tarik Moussa, “State of Climate Tech 2022: Overcoming Inertia in Climate Tech Investing,” PwC, November 2022.