Thought Mortality Was Dead? Considerations for Pensions Given the IRS's Delay in Implementing RP-2014

Longevity risk, the risk that plan participants live longer than assumed, gained widespread attention in October 2014 when the Society of Actuaries released its draft of updated mortality assumptions (called RP-2014). Because this was the first update to the standard assumptions in over a decade, the change from the previous tables was noticeable: a boost of life expectancy of two to three years, on average. By 2016, accounting auditors largely required defined benefit plan sponsors to use the updated assumptions on their financial statements, resulting in an average drop in reported funded status of 4%–8%. 1

Although many sponsors likely thought they had laid the mortality issue to rest, the IRS somewhat unexpectedly decided to delay implementation of the RP-2014 mortality tables until 2018. This decision affected liability valuation for three purposes that are at least partially prescribed by IRS guidance: minimum required contributions, variable-rate Pension Benefit Guaranty Corporation (PBGC) premiums, and lump-sum distributions to terminated vested participants. Practically speaking, this means that for the remainder of 2017, the liability valuation for these three purposes is temporarily lower (and funded status therefore temporarily higher) than it will be once the new tables are adopted. While both the ultimate impact and optimal reaction to this IRS implementation delay will vary widely for individual sponsors (because of different demographics, plan provisions, etc.), this brief discusses what has changed and provides general considerations for all sponsors to weigh in the near term.

Even if no change to investment strategy is warranted, one lesson that all sponsors can glean from this experience is the importance of understanding that the rules for valuing pension liabilities (and therefore funded status) can be dramatically different for different purposes. For this reason, sponsors should ensure that they are equipped with a comprehensive pension strategy that encompasses both funding and investment policies, and that also integrates consideration of potential de-risking options.

What Has (And Has Not) Changed?

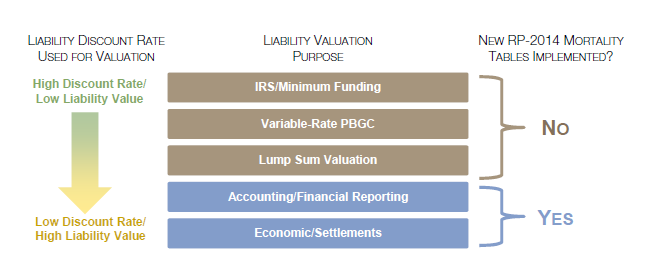

That we are discussing the impact of the new mortality tables at all may rightfully give many sponsors a sense of déjà vu. This is because in two areas, financial reporting and determination of economic valuation, sponsors have already seen the higher liability value (and thus lower funded status) as a result of the implementation of the RP-2014 mortality tables. 2 As shown below, the pension liability must be valued for many different purposes, each of which has distinct rules that govern the discount rate and, for now, required mortality assumption. Because of the IRS’s recent decision to delay implementation of the new RP-2014 tables, the corresponding declines in funded status have not yet been seen in three other areas: calculating minimum contribution requirements, determining variable-rate PBGC premiums, and valuing lump-sum distributions to be paid out to terminated vested participants. We discuss considerations for sponsors related to each of these three purposes below.

Impact Considerations

Calculation of Minimum Contribution Requirements. The funded status used to determine minimum required contributions (which we refer to as “IRS funded status” for simplicity) is based on a complex set of rules first laid out in the Pension Protection Act of 2006 and amended via the Moving Ahead for Progress in the 21st Century Act (MAP–21), the Highway and Transportation Funding Act of 2014 (HATFA–2014), and the Bipartisan Budget Act of 2015 (BBA–15). Generally, a plan’s IRS funded status under these rules is significantly higher than for accounting or economic purposes due to the use of a higher liability discount rate (which makes the liability value much smaller). For example, the effective discount rate allowed under BBA–15 is between 5.5% and 6.5%, while the current discount rate for accounting purposes is approximately 4%. 3 This is why sponsors’ funded status for IRS funding purposes can be, for example, 110% while the PBO/accounting funded status can simultaneously be approximately 80%.

Sponsors should expect to see their IRS funded status decline next year by roughly the same amount as they saw their accounting funded status decline when RP-2014 was first used on their financial statements. In the near term, this may not have a material impact on their minimum required contributions (as shortfall contributions are amortized over seven years). However, sponsors whose IRS funded status is just above the key threshold levels of 80% or 60% should examine whether the mortality table implementation would cause a breach of these levels, resulting in additional restrictions on the plan. These sponsors may consider making a near-term contribution to avoid the regulatory consequences.

Variable-Rate PBGC Premiums. One ongoing expense sponsors face is required premium payments to the PBGC, a government agency designed to provide a backstop to failing pension plans. 4 Each year, in addition to a fixed per-participant premium, sponsors must pay a variable-rate premium if they are not fully funded ($34 per $1,000 of underfunding in 2017, using a liability discount rate that is significantly lower than the one used for minimum contribution purposes). Over the past few years, dramatic increases to these annual PBGC premiums have been tucked into the laws mentioned in the previous section. Now, with variable rates set to jump another 20% over the next two years, premiums by 2019 will be more than quadruple what they were in 2012.

Thus, sponsors can expect a double whammy in 2018 related to variable-rate premiums: higher rates per $1,000 of underfunding from previous legislation and higher levels of underfunding due to the IRS adopting the new mortality tables. These increases in PBGC premiums and uncertainty related to mortality assumptions are two reasons that many sponsors have been taking a closer look at potential de-risking options, including lump-sum offers to certain participants.

Lump-Sum Valuations. Some pension plans allow the option to offer one-time lump sums to participants who have separated from the company but are entitled to benefits in retirement, instead of paying them an ongoing benefit until death. Two possible benefits of offering lump sums include mitigating longevity risk and reducing plan costs, including fixed-rate (and possibly variable-rate) PBGC premiums. 5 Lump-sum valuations are based on a similar discount rate to that used for variable-rate premiums and are also subject to the IRS-prescribed mortality assumption.

Therefore, for sponsors that were already considering offering lump sums to their terminated vested participants over the next few years, the remainder of 2017 offers a rare window in which, all else being equal, the value of the lump sum required to be paid will be lower than in 2018, when the IRS is expected to adopt the RP-2014 mortality tables. Unfortunately, deciding whether accelerating the timing of planned lump sums to take advantage of this—or even choosing whether to offer them at all—is very complex.

Among many other considerations, we are quick to point out three facts related to lump sums. First, from a purely mathematical standpoint, paying out benefits (and particularly large lump sums) while the plan is underfunded results in a lower funded status in percentage terms. 6 This will likely have knock-on effects for future contribution requirements and possibly create restrictions on the plan’s ability to pay lump sums in the future. Second, with a lower asset base, it becomes more difficult to close the funding deficit through asset returns (as opposed to sponsor contributions). Finally, the profile of the liabilities “left behind” after removing terminated vested participants is different, both in duration and the uncertainty of their value—there are simply more assumptions required to value the liability for an active participant than for a terminated vested participant (e.g., compensation increases, expected tenure, and, of course, the rate of life expectancy increases over time).

Is a Change in Investment Policy Warranted?

Most plans will likely not require a dramatic shift in investment policy as a result of the IRS delaying the implementation of the RP-2014 mortality tables. Nonetheless, sponsors may find assessing the impacts on their individual plans to be a valuable process. As may be clear given the discussion of the many disparate rules governing liability valuation for different purposes, sponsors should craft an overall pension strategy that both incorporates and prioritizes the objectives most relevant to them, subject to their unique constraints and risk tolerance. For example, the CFO of a publicly traded corporate plan may care a great deal about the volatility of financial statement impacts, while a non-profit CFO may care more about the timing and volatility of required contributions or the impact on debt covenants. Different strategies and considerations may be appropriate in either case.

See David Druley and Greg Meila, “The Forgotten 70%: Strategies for Pension Plans Accruing Benefits,” Cambridge Associates Research Note, July 2015, and David Druley et al., “Pension Risk Management,” Cambridge Associates Research Report, 2011, for more detail on our pension risk management philosophy.

We have long advocated a holistic approach to pension risk management that encapsulates sponsor-specific objectives and risk tolerance with respect to funding policy, investment policy, and the possible use of de-risking levers (e.g., lump sums, pension risk transfers). Adopting this approach can allow sponsors to be proactive in determining the strategic response most in line with their specific goals and constraints when regulations or assumptions (like mortality) change—particularly when these changes have different impacts on IRS, accounting, and economic liability valuation. This will continue to be important because, even after the IRS adopts the RP-2014 tables, the issue of mortality will not die. While large changes in baseline mortality assumptions (like those from RP-2014) do not occur frequently, smaller tweaks (e.g., to the rate at which mortality improves over time) are made on an annual basis. However, as the recent IRS decision shows, the magnitude and timing of these annual impacts are not always perfectly in sync for IRS and accounting purposes. Sponsors who align their funding and investment objectives as regulations, assumptions, and markets change are thus best positioned to efficiently achieve their objectives.

As a first step toward an integrated pension strategy, sponsors should ensure that all relevant internal stakeholders (e.g., CEO, CFO, Treasurer, HR) understand the various ways in which the pension plan impacts the organization and have a basic understanding that the funded status calculated for one purpose (e.g., minimum required contributions) can be dramatically different than that for another purpose (e.g., arranging pension risk transfers to an insurance company). Additionally, ensuring coordination between all external service providers—including the plan actuary, accounting auditor, and investment advisor—will help ensure that the strategy is being executed properly.

The Bottom Line

The IRS’s somewhat unexpected decision to delay implementation of the RP-2014 mortality tables has impacted at least three separate aspects of pension plan strategy. This highlights the need for sponsors to appreciate the sometimes widely divergent assumptions used in calculating funded status for different purposes. Formulating a holistic pension strategy that appropriately balances sometimes conflicting objectives—and ensuring coordinated execution—is pivotal to creating long-lived success.

Greg Meila, Senior Investment Director

Justin Teman, ASA, Senior Investment Director

Footnotes

- Society of Actuaries, “RP-2014 Mortality Tables Report,” October 2014 (Revised November 2014).

- The economic valuation is used to determine the true economic (or “mark-to-market”) value a life insurance company would pay to settle the liabilities through an arms-length transaction. An insurance company considering a buyout transaction would likely use more sophisticated internal models based on its own experience and plan-specific demographics, rather than the standard RP-2014 mortality tables. However, a sponsor interested in estimating the true economic value internally without such data would use the updated RP-2014 tables rather than the old RP-2000 tables.

- Under BBA–15, the liability is discounted using three segment rates and will therefore vary depending on the exact cash flow pattern for an individual sponsor. Accounting discount rate is approximate as of March 16, 2017.

- Recent premium increases may help improve the financial position of the PGBC itself, which is underfunded relative to its expected liabilities. According to its 2016 annual report, the PBGC is facing a deficit of approximately $20.6 billion for single-employer plans and $58.8 billion for multiemployer plans.

- Variable-rate PBGC premiums are subject to a cap based on the number of participants in the plan, so reducing the number of participants enough could possibly reduce the cap to a level lower than what the plan would otherwise have to pay with more participants.

- For example, consider a plan with $80 in assets and $100 in liabilities (a funded status of 80%). Paying $30 in a lump sum results in $50 of assets and $70 in liabilities (a funded status of 71%).

Greg Meila, CFA - Greg Meila is a Managing Director for the Endowment & Foundation Practice at Cambridge Associates.