The Materiality of Sustainability for Investors

Sustainability is increasingly material to investment returns. In this paper, we discuss five prominent trends that are likely to have relevant implications for investment portfolios over the long term. The five trends we highlight — climate change, multi–stakeholder driven society, resource degradation, demographic challenges, and technological revolution — all warrant attention from investors, even if they have overlapping aspects. We also highlight how sustainability trends have already impacted investment performance and discuss why prices may still not reflect long-term sustainability concerns. Ultimately, investors that evolve more quickly to incorporate these risks and opportunities into their investment decision-making frameworks are likely to be better prepared for the future than their peers.

Trend #1 Climate Change

Climate change is now economically material and actionable for all investors, as is the related ongoing energy revolution that offers the potential to shift to a global low-carbon economy and will have clear winners and losers. It also exacerbates inequality, since it disproportionately affects people of colour, lower-income communities and developing countries. Science strongly suggests climate change is directional and will not mean revert on any timescale relevant to investors. Understanding this can help simplify strategic asset allocation and manager selection decisions and give investors an advantage. This is one area where the past is a poor guide to the future for investors. Impacts for investors to consider include transition risks to high-carbon businesses if we move to a lower-carbon economy and direct physical risks to assets (such as real estate that will be impacted by rising sea levels or a warming climate) if we don’t. Some combination of the two is inevitable. Carbon and location are now two key dimensions to add to any discussion of risk.

In a recent paper, we provided data on the materiality of climate change for investors. Issues that are of particular concern for investors include the multi-metre sea level rises that scientists believe are already baked in by existing carbon emissions, the value of carbon-intensive assets that could become obsolete under de-carbonisation scenarios needed to limit temperature increases below 2.0°C, and the staggering costs of a predicted rise in natural disasters.

Trend #2 Multi-Stakeholder Drive Society

The expectations that society places on companies around social and environmental issues appear to be on the rise 1 , even as some populist political figures back away from climate accords, support coal mining, or boost rainforest logging. Ever rising inequality cannot be a stable equilibrium. At the time of writing, in June 2020, recent material events in the United States have highlighted the critical importance of, and growing expectations around, diversity and racial justice, issues that were already of increasing importance for investors. Standard accounting metrics don’t incorporate the negative environmental and social impacts created by some companies’ business activities — whether degrading the environment or causing social harm. The potential liabilities are off-balance sheet, and this is why they are called ‘externalities’. This has allowed many companies to ‘over earn’. 2 Greater socio-economic accountability is now forcing the internalisation of these costs, changing the competitive dynamics and turning former winners into losers. This pressure from stakeholders can come from regulators, governments, legal claims, non-governmental organisations (NGOs), and consumers employing social media. A holistic investment approach can help identify mispriced contingent liabilities, and identify winners. For example, multiple studies have highlighted how more diverse companies perform better. 3 4

As an example, Bayer underestimated the cost of externalities from the controversial glyphosate weedkiller Roundup when it paid $63 billion to acquire its maker Monsanto in June 2018. The externalities were internalised when health-related court judgements went against Monsanto and investors scrambled to estimate the cost of 13,000 related court cases and country-wide bans of the product. Bayer lost $55 billion of its market capitalisation from mid-2018 to June 2019. Other externalities that might be mispriced today include plastics pollution, carbon emissions, irresponsible marketing of tobacco products in emerging markets, selling unhealthy food 5 , unsustainable agriculture, and the environmental footprint and social cost of the fast fashion business model. 6

Trend #3 Resources Degradation

Our stable climate is not the only natural resource experiencing degradation. Companies whose core activities use resources unsustainably are facing material risks; this presents opportunities for competitors promoting efficient growth. Resource-efficiency opportunities extend beyond the energy and power sectors, encompassing industrials, transportation, manufacturing, agriculture, and real estate. Investors can fund technology supporting the transition from today’s linear economy (make, use, dispose) to an asset-light ‘circular economy’ that minimises waste and makes the most of resources by recovering and recycling them.

Resource degradation can seem academic and removed from investment decisions, but this is increasingly not the case. A UN-backed study predicted, for example, that exploitable fish stocks within the Asia-Pacific region could disappear within 30 years 7 . Land degradation is already harming agricultural productivity on 23% of the planet’s land area. 8 In all, the world loses around 1% of its soil each year, half a percent of arable land, and some studies show there are perhaps 30 to 70 good harvest years left, depending on location. 9 Water stress is also a growing issue globally, with a quarter of the world’s population living in countries now with high-water stress and at risk of ‘day zeroes’ (the term used in 2018 when Cape Town, South Africa nearly ran out of water). 10

Trend #4 Demographic Challenges

As emerging markets (which are a majority and rising proportion of the world’s growing population) consume resources at levels previously associated with developed economies, all three of the previous trends will become more material. Businesses that can provide goods and services more sustainably will benefit, and those that stick to resource-intensive processes face increasing risks.

For example, consider just the production of basic materials needed for eight billion people. Aside from energy and transportation, carbon emissions from the production of steel, cement, plastics, and aluminum alone may prevent countries from meeting global emission reduction targets in the coming decades. 11 More generally, our current model of economic growth is unsustainable. If everyone on earth produced as much carbon as the average person in the United States, global emissions would increase more than threefold 12 , and we would likely face a catastrophic impact on asset prices and society from uncontrolled and irreversible global heating.

New models for financial services and for provision of affordable healthcare provide investment opportunities that would help solve demographic challenges. Investors also have clear options to more sustainably meet the demands of younger populations in emerging markets by bypassing certain capital-intensive or high-carbon business models.

Trend #5 Technological Revolution

How technology is reshaping investment opportunities needs no explanation. Some may question why we are even claiming it as a sustainability trend; technology is the glue that binds nearly all solutions to achieve a more sustainable future. Solving global challenges at the interface of technology and sustainability is a huge investment opportunity. The impact of this may have the magnitude of the industrial revolution at the speed of the digital revolution 13 and spans finance, health, food and agriculture, industry, real estate, transportation, and energy.

As an example, Deep Mind, the British artificial intelligence (AI) company acquired by Google in 2014, was able to cut energy costs by 56% in Google’s vast data centres solely through AI-driven energy management improvements with no hardware changes at all. 14 Deep Mind has also applied machine learning algorithms to Google’s wind power fleet, producing a 20% increase in the realised price of wind energy sold by better predicting wind output. 15 A second example is the potential of autonomous vehicle fleets, electric vehicles, vehicle connectivity, and shared-mobility technology to materially disrupt traditional vehicle sales (and oil demand) in the coming decade. 16 Aggressive scenarios foresee passenger kilometres travelled in private cars falling by more than 70% by 2030, from a 2018 baseline. 17

Evidence of Investment Performance Impact

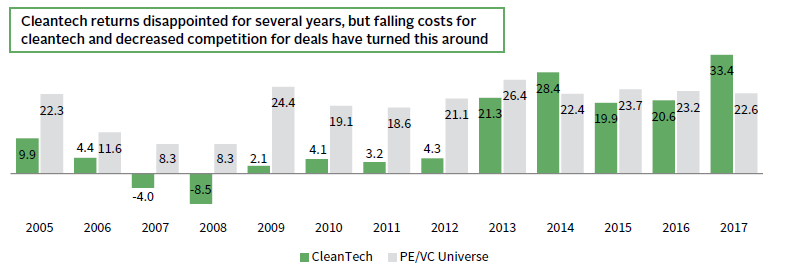

Our argument for using sustainability as a framework for superior investment decision making is economic. Sustainability trends are already having a tangible impact on asset performance. In our database of investment managers, we see evidence that sustainable solutions are driving returns. We recognise the pattern because we have seen it before: consider how falling costs in areas, such as gene sequencing, rapidly fed through to increased investment returns in healthcare venture capital returns. Similarly, we are now seeing large and significant cost reductions in clean technologies. Clean energy technology is now applied beyond the energy industry in areas such as retail, transportation, manufacturing, agriculture, and real estate. 18 Examples include rapid declines in the cost of wind and solar power and battery storage. Such rapidly evolving technology is reshaping the economics of sustainable businesses amid decreased capital chasing deals. Thanks to this combination, the underperformance of the prior decade’s capital-intensive or subsidy-dependent clean technologies is disappearing. Investment returns from cleantech companies held by private equity and venture capital (PE/VC) funds have increased remarkably in the latest vintages (Figure 1).

FIGURE 1 RETURNS OF CLEANTECH COMPANIES BY YEAR OF INITIAL INVESTMENT VS BROADER UNIVERSE

As of September 30, 2019 • Pooled Gross IRR (%)

Notes: Performance includes 1,411 investments and reflects gross deal level returns from 2005 to 2017. These investments are composed of all company-level investments made by private equity and venture capital partnerships assessed as eligible for the CA Clean Tech Company Performance Statistics. As of September 2019, Cambridge Associates (CA) screened over 93,000 investments held by over 7,800 funds to identify cleantech investments. CA includes companies and projects in the cleantech sector if they (1) develop non-fossil fuel energy sources, (2) promote industrial efficiency by conserving resources and replacing existing processes with less-polluting alternatives, (3) recycle waste efficiently, or (4) provide a product or service that creates an environmental improvement. The full report is published quarterly and can be found at http://www.cambridgeassociates.com/private-investment-benchmarks.

We also find evidence that focusing on sustainability boosts returns for public equities managers. A notable array of managers is building strong track records from genuinely integrating sustainability in an economic way rather than through environmental, social, and governance (ESG) box ticking. The latter often obscures best practices and makes thoughtful investors sceptical. We even find evidence of sustainability adding value in index investing. Our 2016 paper investigated why a simple ESG index in emerging markets had materially outperformed the conventional index. The MSCI Emerging Markets ESG Leaders Index 19 selects companies based on ESG metrics, taking the best half of each sector from the parent MSCI Emerging Markets Index. In other words, it simply overweights more sustainable companies and deletes the least sustainable ones. Our attribution analysis showed that conventional factors like style, sector, country, or country-active biases alone could not explain the significant outperformance. Updating this data through April 2020 gives nearly seven years of data since the launch of the live index in June 2013, and this phenomenon has persisted, with roughly 60% of the 2.4% annualised alpha over the standard index not explained by other factors, but rather by ESG-based stock selection. We argue that sustainability can continue to add value looking forward in emerging markets as lower ESG standards 20 here catch up.

Beyond emerging markets equities, a study in 2020 21 found that the majority of 745 sustainable funds using ESG criteria, from a universe of 4,900 funds across seven categories 22 , outperformed non-ESG funds over one, three, five, and ten years through December 2019. The study showed that this outperformance continued through the COVID-19 sell-off in six of the seven categories in first quarter 2020.

Why Sustainability May Be Mispriced

Sustainability trends are clearly material; however to generate outperformance over an investment’s holding period, they must be mispriced at the time of investment. Sustainability isn’t properly priced because investors tend to have short-time horizons, behavioural biases, and an over-reliance on history that is less relevant in the face of issues like a changing climate.

Short Termism and Narrow Focus

Financial analysis is typically based on three- to five-year horizons, with linear extrapolation afterward. A paper by Generation Foundation explains that sustainability issues are not ‘black swans’, or unpredictable material events, but are rather ‘white swans kept in the dark’ by the short-time horizon of typical financial analysis. 23 Financial analysis tends to break down when a phenomenon is accelerating (e.g., climate risk) or de-anchors from the status quo (e.g., the sudden repricing of an externality, or a future step change in regulation against carbon). Cash flow projections also underestimate almost-certain occurrences at an unforeseen point, such as single, catastrophic, weather-related events, which are becoming more frequent. For example, electric utility PG&E Company, described by The Wall Street Journal in 2019 as the first ‘major climate-change bankruptcy’ 24 , rapidly fell from a $25 billion market capitalisation to Chapter 11 bankruptcy protection. Their downfall was caused by liabilities from wildfires started by their power lines, with these fires now more prevalent due to increasingly dry and hot weather patterns extending north in California.

Investors show short termism and narrow focus when they invest in fossil fuel producers based only on profit expectations that depend on high energy prices and production volumes. The need to de-carbonise the global economy presents new threats to the value of these assets. These threats include regulation, legal action, or faster-than-expected substitution as renewable power and electric vehicles become increasingly economical. 25 The 2015 Paris Climate Agreement’s target to limit warming to 2°C implies rapid declines in carbon emissions to reach carbon neutrality in around 35 years. Multiple studies 26 have shown that such scenarios mean a substantial portion of known coal and oil & gas reserves are unburnable and become ‘stranded assets’, impairing their value to investors. For example, the original stranded assets paper by Carbon Tracker 27 stated that up to 80% of known reserves were unburnable in a 2°C scenario. 28

Other studies have examined why markets may price these risks incorrectly. 29 30 Beyond short termism, one possible potential systematic overvaluation bias is the energy industry’s net asset value (NAV) assumptions, which assume future exploitation of 100% of current economic reserves. This made perfect sense historically — if you owned an asset, why wouldn’t you monetize it? — but is challenged by stranded asset scenarios. There is also a potential ‘overvaluation trap’ where capital markets overvalue reserves, and companies, therefore, invest in more reserves despite the risks, since stopping it would signal that current reserves are less valuable. 31

The other very clear indication that participants do not discount 80% of current reserves as unburnable is that almost all fossil fuel producers keep investing the vast majority of their capital expenditure adding more. Top oil & gas companies jointly spent only 1% of their 2018 budgets on clean energy. 32 Investors in new reserves either don’t believe emissions will be curbed, or conclude that if they are, someone else’s assets will be stranded. As long-term investors, we don’t take comfort from the former, since the economic consequences of the current ‘business as usual’ uncontrolled warming climate scenario would be materially negative for these companies’ valuations 33 due to widespread physical risks potentially impacting asset values. The latter is simply not realistic: research has shown that just the known reserves of listed energy companies exceed the global carbon budget for a 2°C scenario despite comprising a small proportion of reserves.

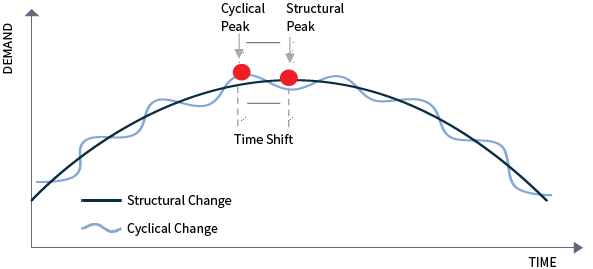

At the time of writing in June 2020, we have seen major declines in the values of fossil fuel assets through the COVID-19 crisis. It may be important to consider to what degree these longer structural challenges could compound shorter-term demand destruction. Has the peak demand for oil been brought forward, and should we view apparent cyclical opportunities to invest in fossil fuel assets with more caution than in previous cycles? Figure 2 illustrates the potential threat.

FIGURE 2 WHEN STRUCTURAL CHANGE MEETS CYCLICAL CHANGE

Source: Carbon Tracker.

Sustainability trends, including the move to a low carbon economy, may impact the asset values of many other businesses, and these companies may be mispriced, given the lower profile of climate issues in industries outside of the energy and utility industries. Carbon is emitted everywhere in a portfolio, and risks span assets in the basic materials, autos, real estate, agriculture, transportation, chemicals, and insurance sectors. Agriculture, forestry, and other land use alone is responsible for 23% of all man-made carbon emissions. 34 A 2017 joint study by the International Energy Agency and the International Renewable Energy Agency 35 , estimates that necessary carbon mitigation efforts could strand up to $7 trillion of assets within upstream energy and related infrastructure, and when expanding the window to include the electricity generation, industrials, and buildings sectors, the total of potentially stranded assets rises to $20 trillion. 36

Behavioural Biases

Evidence suggests that collectively, investors struggle to assess the materiality of issues that are emotionally charged. This is unsurprising since globally existential threats, of which we believe climate change and resource degradation are examples, are rare. Many of the impacts of climate change are believed to be irreversible, which makes it unique. It’s problematic for investors to make comparisons with prior ‘disasters’ and incorporate the resulting mean reversion into their assumptions. More so, it is difficult or even uncomfortable to comprehend that the old financial toolkit may not work anymore! Vested interests and politics also obscure economic sustainability arguments.

The potential unsustainability of a fossil fuel–based economy, and issues like ‘stranded assets’ are not just emotive, but also can be a controversial or even taboo topic for investors happy to take clear positions on other disruptive trends. This is completely understandable since our economy was built around fossil fuels, whose reliable supply and affordable cost were historically seen as issues of national importance. But, this can result in behavioural biases when assessing how our relationship with these fuels is changing. Furthermore, emotive biases in the other direction could eventually push other investors to discount carbon-intensive assets even if their price were to eventually incorporate the impact of stranding; the move to a lower-carbon economy is a transition where the exact pace is unclear, and this requires objective assessments by investors.

Some prominent financial experts believe climate change is a materially underpriced risk, and we agree. Mark Carney, the Governor of the Bank of England, has repeatedly warned of a future climate ‘Minksy Moment’ 37 (a term used to describe a sudden collapse in asset prices based on economist Hyman Minsky’s investigations of financial crises throughout history). A potential scenario of asset price collapse could follow very extreme weather events that cause direct losses, particularly for the insurance industry, but then lead to both an acceleration in regulations against carbon and a repricing of physical risks.

Historic Data and Trends May Now Be Less Useful

Sustainability trends are directional. They take us somewhere new. They imply that historic data may be less useful. They also imply a need to embrace uncertainty and change. Where we have useful data, it is often recent and therefore open to questioning.

Consider that the last four years were the four hottest years globally in recorded history, while the 20 warmest years on record have been in the past 22 years; the warmest ever recorded seas occurred in the last two years, and some extreme weather events are rapidly becoming more severe and/or frequent. 38 These developments have the potential to impact physical assets directly in many asset classes (including real estate, agriculture, and infrastructure). Risk measures used by the insurance industry and investors may be less useful if based on longer-term historic weather and loss data, given that recent trends are arguably much more relevant than older datapoints.

Investors may also have to reassess historical measures such as the inflation sensitivity of investments, since the drivers of inflation in a more sustainable and more circular economy will diverge from those that drove inflation in the past. To state the obvious, carbon is unlikely to be a good inflation hedge in a de-carbonising economy, yet it still looms very large in most ‘inflation-sensitive’ asset allocations.

Willingness to Be Different May Be Important

Maverick risk is the risk of being different from the pack. Given the materiality of sustainability trends, is the ‘neutral’ position of owning the market a safe place to be when the market portfolio faces structural challenges? If it isn’t, this means taking on substantial amounts of active share and tracking error risk to a benchmark. Not all investors are ready for this shift, particularly now with the substantial rise in passive investing and institutional governance constraints.

Consider a (real) situation with Emerging Markets Public Equity Manager X. They pursue a proactive sustainability focused strategy, and over the decade since their inception are comfortably outperforming their index and peers. They view the MSCI Emerging Markets Index as risky, backward-looking, and particularly unsustainable, especially constituents like fossil fuel producers and heavy carbon emitters (e.g., coal-fired utilities and cement companies). The index also has a very substantial weighting to state-owned enterprises with a poor track record on ESG issues and little alignment with minority investors as long-term stewards of capital. This manager, therefore, avoids a very large portion of its benchmark, and in contrast, substantially overweights companies it believes are oriented toward a more sustainable model of economic development. The manager’s sustainability focus therefore means — in fact demands — a large active share and tracking error to the index and a focus on the absolute risk of permanent loss of capital over relative risk.

Notably, at the time of writing during the COVID-19 crisis, this willingness to be different and embrace sustainability trends is resulting in material outperformance by public equity managers that we consider to be sustainability thought leaders. The search for resilient, future-relevant companies has generally avoided many of the sectors hardest hit by the recent sell-down: the undifferentiated business models reliant on endless growth with no particular moat or intellectual property (e.g., fossil fuel and other commodity producers, airlines, steel). On the other hand, the sustainability lens leads some managers to overweight asset-light digital disrupters, which are proving more resilient than physical asset–heavy incumbents in this challenging environment. Sustainability has meant durability. We don’t consider this to be coincidental and the pandemic could accelerate some of the trends discussed here; 2020 may prove to be an important stress test for themes of this report.

Conclusion

Sustainability trends are disruptive, will not mean revert, and will take the investment landscape to somewhere new. They are material and can be mispriced and overlooked. By drawing on all the strengths of a diversified long-term investment framework, while looking at the widest range of material financial and sustainability inputs, investors can exploit this investment opportunity, avoid risks, and build resilient portfolios that meet their long-term objectives.

Chris Varco, Managing Director

Annachiara Marcandalli, Managing Director

Lydia Guett, Associate Investment Director

Footnotes

- See Maria Shao, ‘Social Pressures Affect Corporate Strategy and Performance’, Stanford Graduate School of Business Insights, 1 December 2009.

- Kristian Heugh and Marc Fox, ‘ESG and the Sustainability of Competitive Advantage’, Morgan Stanley, 2017.

- Vivian Hunt, Dennis Layton, and Sara Prince, ‘Diversity Matters’, McKinsey & Company, February 2015.

- Rocío Lorenzo, et al., ‘How Diverse Leadership Teams Boost Innovation’, Boston Consulting Group, 2018.

- Andrea M. Teng, et al., ‘Impact of Sugar–Sweetened Beverage Taxes on Purchases and Dietary Intake: Systematic Review and Meta-Analysis’, Obesity Reviews, vol 20, no. 9, September 2019.

- United Nations Environment Programme, ‘Putting the brakes on fast fashion’, 12 November 2018.

- IPBES, ‘The Assessment Report on Land Degradation and Restoration’, March 2018.

- IPBES, ‘The Global Assessment Report on Biodiversity and Ecosystem Services: Summary for Policymakers’, May 2019.

- Please see Jeremy Grantham, ‘The Race of Our Lives Revisited,’ GMO White Papers, 8 August 2018.

- Rutger Willem Hofste, Paul Reig, and Leah Schleifer, ‘17 Countries, Home to One-Quarter of the World’s Population, Face Extremely High Water Stress’, World Resources Institute, 6 August 2019.

- ‘The Circular Economy: A Powerful Force for Climate Mitigation’, Material Economics, June 2018.

- ‘Our World in Data: 2017 Emissions Data’, University of Oxford, 2017.

- Generation Investment Management, ‘Global Client Conference’, 2018.

- Deep Mind presentation, Generation Investment Management, Global Client Conference 2018.

- Carl Elkin and Sims Witherspoon, ‘Machine Learning Can Boost the Value of Wind Energy’, Deep Mind, 26 February 2019.

- Troy Baltic, et al., ‘How Sharing the Road is Likely to Transform American Mobility’, McKinsey & Company, 11 April 2019.

- Eric Hannon, et al., ‘The Road to Seamless Urban Mobility’, McKinsey & Company, 16 January 2019.

- Temple Fennell, et al., ‘CLEAN TECH 3.0: Venture Capital investing in Early Stage Clean Energy’, Ceres, November 2017.

- At the time of the 2016 paper, the index was called the MSCI Emerging Markets ESG Index before being renamed.

- See discussion in Andrea van Dijk, Lotte Griek, and Chloe Jansen, ’Bridging the Gaps: Effectively Addressing ESG Risks in Emerging Markets’, Sustainalytics, June 2012.

- Hortense Bioy and Dimitar Boyadzhiev, ‘How Does European Sustainable Funds’ Performance Measure Up?,’ Morningstar, June 2020.

- The categories spanned various global, emerging markets, US, and European equity categories, as well as Euro corporate bonds. The selected categories were determined based on the availability of sustainable funds with ten-year returns.

- Mona Naqvi, ‘All Swans Are Black In The Dark: How The Short-Term Focus On Financial Analysis Does Not Shed Light On Long Term Risks’, Generation Foundation and 2° Investing Initiative, February 2017.

- Russell Gold, ‘PG&E: The First Climate-Change Bankruptcy, Probably Not the Last’, The Wall Street Journal, 18 January 2019.

- Eric Gimon and Mike O’Boyle, ‘The Coal Cost Crossover: Economic Viability Of Existing Coal Compared To New Local Wind And Solar Resources’, Energy Innovation, March 2019.

- See ‘Stranded assets and renewables: How the energy transition affects the value of energy reserves, buildings and capital stock’, IRENA, July 2017.

- James Leaton, ‘Unburnable Carbon: Are the world’s financial markets carrying a carbon bubble?’ Carbon Tracker, November 2011.

- By unburnable, we mean that the fuel’s high carbon emissions make it incompatible with likely regulatory frameworks that would support holding the temperature rise to just 2°C. This framework might include bans, quotas, a carbon tax, or regulatory support for alternative energy. Stranded assets are hydrocarbon reserves and related infrastructure that can no longer be used (either such use becomes illegal, or becomes uneconomic, thus impacting their value).

- See Dr. Dinah A. Koehler and Bruno Bertocc, ‘Stranded assets: What lies beneath?’, UBS Asset Management, March 2016.

- See Thomas Lee, ‘Fossil Fuel Stranded Assets: Efficient Market Or Carbon Bubble?’, Wharton Public Policy Initiative, April 2017.

- Roger Martin and Alison Kemper, ‘The Overvaluation Trap’, Harvard Business Review, December 2015.

- Ron Bousso, ‘Big Oil spent 1 percent on green energy in 2018’, Reuters, 11 November 2018.

- Roger Martin and Alison Kemper, ‘The Overvaluation Trap’, Harvard Business Review, December 2015.

- IPCC, ‘Climate Change and Land’, August 2019.

- IEA and IRENA, ‘Perspectives for the Energy Transition’, 2017.

- The $7 trillion estimate includes assets of both listed and unlisted firms.

- Open letter on climate-related financial risks, Bank of England, April 2019.

- See for example, ‘2014 National Climate Assessment’, US Global Change Research Program (USGCRP) federal program.

Annachiara Marcandalli, CFA - Annachiara Marcandalli is the Global Head of SII Solutions at Cambridge Associates. She also leads the firm’s Italian business.

Chris Varco - FootnotesSee Maria Shao, ‘Social Pressures Affect Corporate Strategy and Performance’, Stanford Graduate School of Business Insights, 1 December 2009. Kristian Heugh and Marc Fox, ‘ESG and the Sustainability of Competitive Advantage’, Morgan Stanley, 2017. Vivian Hunt, Dennis Layton, and Sara Prince, ‘Diversity Matters’, McKinsey & Company, February 2015. Rocío Lorenzo, et al., ‘How Diverse Leadership […]