Liquidity Hazard Planning for Families of Wealth

Families of significant wealth can experience sustained periods of time where liquidity is not a foremost priority. Demands for liquid capital can rapidly emerge, however, like the sudden onset of the COVID-19 crisis in March 2020, and cause trouble for the unprepared. In the worst-case scenario, investors may need to sell growth-focused assets during a drawdown to fund liquidity needs, undoing hard-earned portfolio outperformance. However, this situation can be avoided through careful portfolio management and planning. To manage liquidity risk, families should employ best practices, monitoring illiquid investments, spending needs, and currency considerations. By doing so, they can guard against unanticipated stressors and remain on track to achieve their investment goals.

Why Managing Liquidity Risk Is Important

A thorough calibration of liquidity is essential for all families, including those with multigenerational time horizons and limited spending needs. Liquidity demands are not always external and can emerge from within a portfolio. In times of market stress, liquidity demands can develop out of portfolio rebalancing needs, funding capital calls from private investments, and the desire to capture new growth opportunities alongside withdrawals.

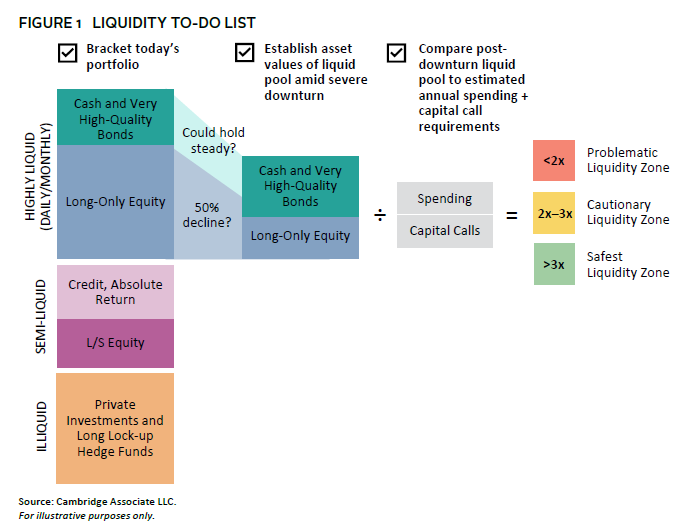

Investors can carry out some simple inquiries and stress tests to help better manage liquidity risk. As a starting point, they should take stock of their portfolio’s liquidity profile and identify those assets that are liquid on a monthly or more frequent basis. This analysis should be thorough and reflect the specifics of the portfolio while avoiding any asset class–level assumptions. For example, a manager’s ability to limit redemptions should be considered. Next, investors can test their liquid assets using different stress scenarios, such as the 2008 Global Financial Crisis, and compare those stressed values with the portfolio’s annual cash demands.

As a rule of thumb, there should be a ratio of post-stress liquid assets to annual cash needs of at least 3x (Figure 1) 1 . This ratio is based on a somewhat draconian scenario, but by being conservative, investors can ensure there is headroom to rebalance and add to beaten-up allocations in times of stress. If the ratio is below 3x, investors should consider ways to increase liquidity in advance of any potential market turmoil, as forced action during volatile times will likely prove harmful. A greater level of portfolio liquidity need not alter a portfolio’s risk profile and asset allocation framework. However, changes to the portfolio’s implementation should be considered. For example, a hedge fund allocation might be overly concentrated in managers with substantial gates 2 and a public equity allocation could consist of more liquid vehicles. Only in extreme scenarios will investors need to revisit the size of their private investments (PI) programme and planned commitment pacing.

Best Practices for Family Investors

As is often the case in investing, it is critical when performing liquidity analyses to challenge any assumptions – both explicit and implicit – that may be inherent in the portfolio’s construction. Has the impact of a large currency movement been considered? Or the potential for a changing cash-flow pattern of private investments?

Liquidity can influence portfolio management for family investors in many ways. Some of the most common channels include illiquid investments, spending needs, and currency considerations.

Private Investments

A deep understanding of the current and future liquidity profile of a PI programme is essential to helping families avoid rash decisions during crisis periods, which can result in lost opportunities and, in a worst-case scenario, impair long-term performance through actions such as distressed sales via secondaries. Such an understanding can also help families reap the rewards of sticking to their planned commitment pacing throughout market downturns, as these periods have historically produced some of the most attractive vintage years.

Over recent years, many family investors have increased their allocations to illiquid investments as they have sought to take advantage of their long-term time horizons and capture the associated benefits.

Commitment modelling is a key step that can help families gain a clearer understanding of their PI liquidity. These models aid in determining an appropriate commitment pace to reach the target allocation, as well as clarifying expectations of future cash flows from capital calls and distributions. In addition to modelling, simply tracking unfunded commitments can be helpful in quantifying potential future liquidity demands.

For families building allocations to private investments, modelling can be particularly valuable, as the allocation will likely be a drain on portfolio liquidity for several years. Once fully developed, a programme’s cashflows can become more predictable and potentially even self-funding over time.

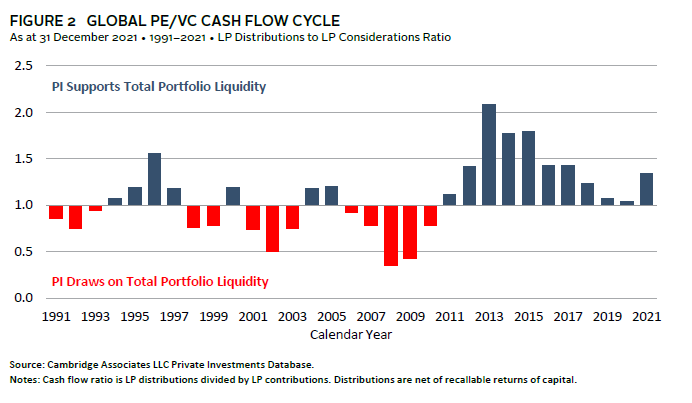

Alongside the maturity and composition of an allocation, the external market environment can also meaningfully impact cash flows of private investments. For example, in a weakening market, as the possibility of general partner exits diminish, the ratio of distributions to contributions will likely decline (Figure 2) 3 . Investors should consider the impact of a changing distribution/contribution ratio on their total portfolio liquidity, particularly during periods of heightened volatility and uncertainty.

Spending Needs

Portfolio spending for families can be more flexible than for other large investors, such as pensions or endowments. While this flexibility can be beneficial at times, the focus when stress testing liquidity should be on the possibility of unexpectedly elevated withdrawals in times of stress. When performing the stress test, family investors should include a higher level of spending than has historically occurred or is deemed feasible. Scenarios where the investment portfolio supports an operating business or other direct investments should also be considered.

Family investors with an operating business that serves as a source of portfolio liquidity, through dividends or otherwise, should also consider how business performance correlates to broader macroeconomic conditions. For example, an operating business may see its profitability and dividend payments decline during an economic slowdown at the very same time as the family’s investment portfolio experiences a decline in liquidity. This consideration is particularly pertinent if the funding of private investments is dependent on this external liquidity source.

Family investors can preemptively manage liquidity risk related to spending through imposing guardrails on their spending rate within their investment policy statement – a document that clearly establishes the objectives, investment policies, and goals of a portfolio. Some family investors include a maximum withdrawal rate in any given year, while others employ a more complex approach that seeks to smooth real notional spending over time while preserving the real value of the portfolio. Such guardrails can provide a Ulysses Pact 4 for a family and help families avoid being pulled off course in times of stress in the future. A line of credit can also be maintained to help meet short-term liquidity needs and avoid disrupting long-term investment plans through the unexpected liquidation of investments. While the benefits of a credit line are clear, it is important to consider the cost, as access will come at a price, especially in a higher interest rate environment.

Currency Considerations

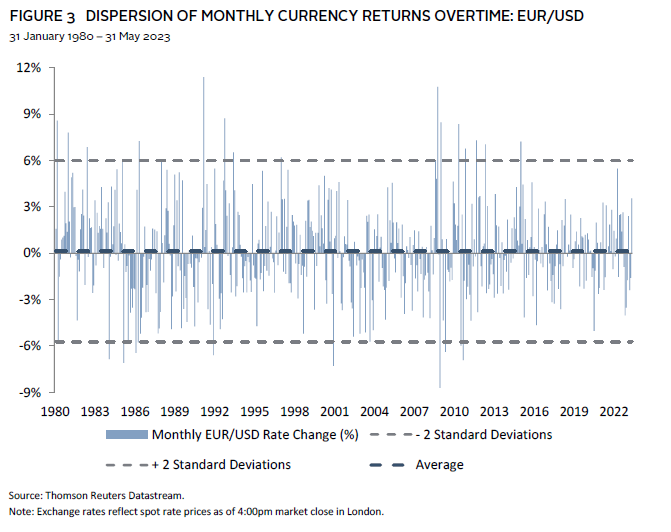

The various channels through which currency can impact liquidity also deserve attention. This is especially important for families with a base currency other than the US dollar, given the lion’s share of today’s global investment universe – especially within private markets – is dollar denominated. Indeed, the US dollar’s surge in 2021–22 was a reminder of how extreme and prolonged currency movements can be. In fact, for many families, this episode shone a bright light on how currency can adversely impact a portfolio’s liquidity.

For family investors with large private allocations, carefully tracking the size of unfunded private commitments outside of their base currency is a simple, yet valuable, task. A meaningful appreciation in a foreign currency can see unfunded commitments swell, as families outside of the United States saw in 2022. On top of tracking this unfunded commitment exposure, family investors can model the impact of a large, but conceivable, currency move – say 2 standard deviations 5 – on its size (Figure 3).

Strategic currency hedging programmes can also create liquidity stress through larger-than-usual margin calls when dramatic currency movements occur. Once again, European family investors that hedge US dollar exposure may have seen this occur in 2022. Moreover, the 2022 UK pension liability-driven investment crisis also gifted the investment world with an insight into how margin calls related to a hedging programme can cause havoc. Fortunately, currency hedging for families does not suffer from the same self-fulfilling ‘doom loop’ that UK pension schemes faced. Families can smooth the impact of margin calls from currency hedging through a thoughtful and institutional-quality approach to their hedging programme. For example, an investor might use a series of overlapping six-month forward contracts to smooth potential cash flows.

Through an awareness of currency considerations, global family investors can better understand and manage the potential variability in their annual cash needs and avoid being caught out when another sharp currency move inevitably occurs.

Conclusion

Consistently revisiting potential liquidity risk is important work for family investors, as many of these risks can lay silent for prolonged periods and become easy to overlook. In fact, unexpected liquidity demands can undo a lot of hard work and, in a worst-case scenario, force a fire sale of assets. By carrying out regular liquidity risk analyses and remaining mindful of the liquidity demands of PI allocations, spending, and any additional currency fluctuations, family investors will be better prepared to navigate short-term disruptions related to liquidity and stay on track to deliver on their long-term objectives.

Adam Barber, Senior Investment Director, Private Client Practice

Footnotes

- The desired ratio of 3x is based on examining the longest historic downturn and ensuring liquid assets can cover withdrawals over its length. Full details of the stylized stress scenario can be found in the original paper from 2019.

- The term “gates” refers to the ability of managers to partially limit the ability of investors to redeem capital from a hedge fund.

- Alongside distributions, capital calls have also historically slowed during crises, given that general partners tend to face larger bid-ask spreads, funding challenges in debt markets, and greater uncertainty around underlying earnings potential. When modelling a stressed scenario, investors should not assume that this slowing of calls will be repeated.

- Based on Homer’s The Odyssey, a Ulysses Pact is a type of commitment device that is formed in the present to protect oneself in the future by limiting future choice.

- If we assume a currency pair is normally distributed, then the likelihood of a one-sided 2 standard deviations or greater event is c.2.5%. In reality, currency returns tend not to be normally distributed, and large movements have historically occurred more frequently than such a distribution would suggest.