Institutional investors should very carefully consider the risks of cryptocurrencies before investing. In our opinion, focusing on investing in companies seeking to profit from the development and adoption of blockchain technology and/or fintech in general, rather than holding cryptocurrencies directly, may be the better option.

The rapid rise in the price of bitcoin in 2017 has thrust “cryptocurrencies” into the spotlight and raised the issue of whether this is a new asset class that institutional investors should consider. In this paper, we lay out the hope, hype, and our concerns around cryptocurrencies. 1

In short, we think cryptocurrencies are generally displaying the classic signs of an investment mania and that institutional investors need to very carefully consider the risks of cryptocurrencies before investing. Cryptocurrencies use blockchain technology, but they are not “the block chain” and have no fundamental source of economic return. In our view, investors would be better served focusing on investing in companies seeking to profit from the development and adoption of blockchain technology and financial technology (fintech) in general, rather than holding cryptocurrencies directly.

The Boom

By late October, the price of bitcoin had surged more than 800% over the previous 12 months, rising above $6,000 in intraday trading after recovering from a 30% sell-off in September amid news that China had taken steps to shut down cryptocurrency exchanges and ban initial coin offerings (ICOs).

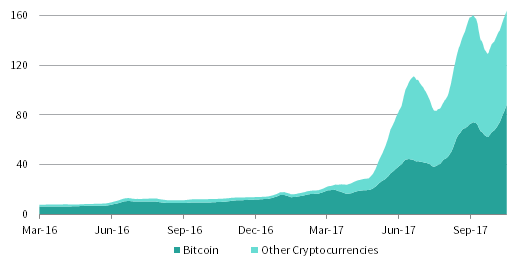

While bitcoin is the highest profile cryptocurrency, it is by no means the only one. Over 400 cryptocurrencies have a market capitalization of at least $1 million; the overall market value of cryptocurrencies has risen from less than $20 billion in early 2016 to over $160 billion on October 20, an all-time high (Figure 1).

FIGURE 1 CRYPTOCURRENCY MARKET VALUE

March 4, 2016 – October 20, 2017 • US Dollar (billions)

Sources: Coin Dance and Coin Market Cap.

Notes: Shown as a 14-day moving average. The market value of a cryptocurrency is equal to its price per coin multiplied by the number of coins outstanding.

To proponents, this rapid growth is a sign of growing adoption of cryptocurrencies and a harbinger of the shift away from government-backed fiat currencies. Cryptocurrencies’ advantages include:

- Potential lower transaction costs given disintermediation of the banking system,

- Anonymity (also due to lack of reliance on the banking system), and

- Ability to be a better store of value vis-à-vis fiat currencies given limited supply.

The rising volume of bitcoin transactions—which exceeded 260 million cumulative transactions in October—is seen as the fundamental driver of the recent rally as growing adoption creates a network effect that potentially becomes self sustaining, as seen in other technologies. Cryptocurrencies are the “way of the future,” with plenty of scope to take more transaction volume away from government-backed currencies and disrupt the existing global payments system. Given what the future might bring, the potential upside is still massive.

Or at least that’s the current narrative told to justify the recent surge in prices.

The Bubble

There is certainly some truth to the bullish case for cryptocurrencies. However, students of financial history are well aware that all investment manias and bubbles start with an initial reasonable premise or compelling story that is then taken to an extreme and over-extrapolated. While each mania is unique, bubbles do share a few common factors.

The first factor is some sort of scarcity. Something “new” has emerged and is “under-owned.” The second factor is an initial sharp rise in prices aided by the emergence of a platform for price discovery, which allows others to observe the rise in prices and draws new entrants into something previously niche. The third is a lack of liquidity. While prices are rising, relatively few “investors” are selling—most are accumulating and hoarding. The buy transactions drive prices higher and set a new benchmark for other holdings, thus creating the illusion of liquidity. Finally, all bubbles come to an end, with a key cause being the emergence of excess supply. At some point the price has risen so high that the new supply overwhelms demand, as the supply of new buyers is also exhausted.

Does the cryptocurrency boom add up to a bubble? Let’s assess bitcoin through this framework.

Scarcity. A key part of the bitcoin narrative is scarcity. The supply is supposedly fixed as according to the protocol only 21 million bitcoins will be “mined” while nearly 17 million bitcoins (80%) are already in “circulation.” 2 Given this, proponents have argued bitcoins should be a more reliable store of value than government-backed paper currencies, which are infinite.

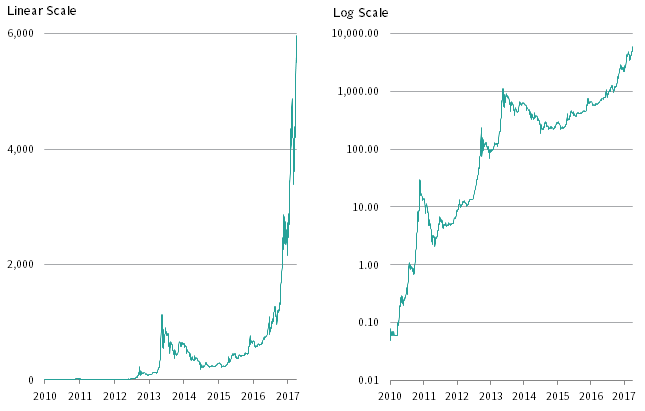

Sharp Rise in Prices. Figure 2 shows the price of bitcoin on both a linear and logarithmic scale, with the latter arguably the better way to display historical prices given the exponential growth since 2010, when price data first became available and bitcoins could in theory have been purchased at $0.06. 3 Indeed, the early holders of bitcoin have seen the largest gains. Investments in 2010 of a few hundred dollars would be worth millions today for those able to hold on this long.

FIGURE 2 BITCOIN PRICE

July 19, 2010 – October 20, 2017 • US Dollar

Source: Bloomberg, L.P.

Lack of Liquidity. As mentioned earlier, bitcoin transactions are rapidly rising, with the cumulative number reaching over 260 million. How many of these represent transactions for goods and services, rather than financial transactions between holders of bitcoin (i.e., buying and selling), is unclear as the data are not available. While the initial interest in bitcoin stemmed from its ability to be an anonymous medium of exchange (and thus its early adoption by criminal elements), the formation of coin trading exchanges coupled with rising prices has attracted new entrants who are not using bitcoins as a medium of exchange, but rather are hoarding them in expectation of future price gains or out of fear of missing “the next big thing.” This pushes prices higher and creates the illusion of liquidity.

Excess Supply. As the laws of economics suggest, high prices have elicited a supply response. Bitcoin split in August into two different protocols and another series of “forks” are expected in November, 4 while this year has seen a rash of ICOs hitting the market. Each of these new cryptocurrencies has a limited supply, but in aggregate the supply of cryptocurrencies is increasing and the market is slowly being flooded. Many of these ICOs are arguably get-rich-quick schemes to ride the wave of interest in the sector. 5

The Bust?

This story of a new innovation/asset/commodity creating huge returns for early adopters—which garners attention and in turn attracts new buyers who also see rapid gains, attracting more attention, etc.—is a well-documented phenomenon. 6 To us, bitcoin and cryptocurrencies in general are experiencing clear signs of a bubble.

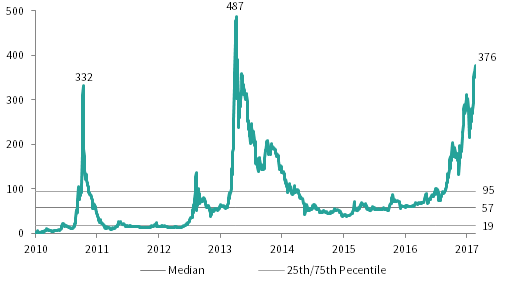

A sharp rise in prices might not matter if underlying fundamentals are keeping pace. Bubbles are really about prices disconnecting from fundamental value. While determining the fundamental value of bitcoin is difficult and a bit like determining the fundamental value of gold, we have attempted to do so by looking at the bitcoin price relative to transactions per coin—a sort of crude price-earnings (P/E) ratio. This analysis assumes that so long as the number of transactions is rising faster than bitcoins are being “mined,” bitcoin prices should rise. Using this framework, the recent surge in the price of bitcoins has massively outpaced transactions per coin, although to a lesser extent than the surge in 2013 (Figure 3). Still, at a value of 376 relative to a median of 57, buyers of bitcoin today are exposed to dramatic price risk, and in the past bitcoin has suffered drawdowns of 80% to 90% (Figure 4).

FIGURE 3 RATIO OF BITCOIN PRICE TO TRANSACTIONS PER COIN

September 1, 2010 – October 20, 2017

Source: Blockchain.info.

Note: Data are daily and represent the USD price of bitcoin divided by the numbers of transactions per coin outstanding.

FIGURE 4 BITCOIN PRICE: PERCENT DECLINE FROM RECENT PEAK

September 1, 2010 – October 20, 2017 • Percent (%)

Source: Bloomberg, L.P.

Note: Data are daily and represent the percent decline from the most recent peak in the price of bitcoin.

Part of the dramatic rise in bitcoin in 2017 is directly related to the surge in ICOs. Many of the ICOs require participants to first purchase bitcoins (or ether, a rival cryptocurrency based on the Ethereum blockchain protocol that forms the basis for many of the new ICOs), which are then exchanged for the new coins/tokens. Given the limited liquidity of the new coins, early investors in the ICO (who often receive allocations at discounted pre-sale prices, reminiscent of the IPO scandals of the late 1990s tech boom 7 ) often then cash out of their new coins and back into bitcoins. Thus, as long as there is “hot” demand for ICOs, there is a rising demand for bitcoin and ether to fund these ICOs, creating a virtuous circle.

This also explains why bitcoin suffered a sharp drawdown in September following the news that China plans to ban ICOs and cryptocurrency exchanges in general. Some commentators argue the October rally in bitcoin is being driven by unconfirmed rumors that China may not follow through on the ban, while other commentators pin the rebound on the upcoming set of “forks” which will see holders of BTC receive additonal coins under the new protocols.

Ultimately, it’s not clear what will cause cryptocurrencies to lose their allure. Maybe it will be rising interest rates that make bank deposits seem worth having (cryptocurrencies do not pay interest). Maybe a few ICOs will flop and that will start a rush for the exits. Or maybe it will be a regulatory crackdown. The more widespread cryptocurrencies become, the bigger the threat they pose to government-backed currencies and therefore the higher the odds of a regulatory backlash. In other words, cryptocurrencies could become victims of their own success.

True, governments cannot ban a piece of code or even track cryptocurrencies particularly well. However, governments retain control over what is deemed “legal tender” for the payment of taxes and what types of transactions are allowed. Banning banks and other regulated intermediaries from processing cryptocurrency-related transactions—such as transferring money to and from exchanges—would have a significant impact on the market.

Cryptocurrencies are only valuable in the eyes of most people because you can exchange them (i.e., sell them) for other currencies—US dollars, euros, renminbi, etc.—and then do something else with that money. Few holders of bitcoin actively use it for purchasing goods and services—partly due to the volatility of the price, but also because they hope to benefit from future price increases. As a result, despite all of the talk about rising transactions, the primary reason for holding cryptocurrencies currently is as a store of value (i.e., an asset), not a medium of exchange. If regulators prevent the processing of cash transfers by the exchanges or other related payments, investors are left with a “stranded asset” or “mock money” on a trading platform.

China’s move to effectively ban cryptocurrencies is a major development, driven by the desire to prevent their usage in helping to avoid capital controls and also to halt the growing instances of ICO frauds being committed in China. 8 If a sufficient number of countries take action to restrict investor access, the speculative demand for bitcoin and other cryptocurrencies could collapse, killing the supply of new entrants, vanishing the illusion of liquidity, and reverting the primary usage of bitcoin back to facilitating illicit transactions.

This is a further consideration for potential investors. The usage of cryptocurrencies by criminal elements creates another source of regulatory risk and poses headline risk for institutional investors that already face pressure to implement environmental, social, and governance (ESG) frameworks. To the extent that cryptocurrencies may support drug, weapons, and human trafficking, they are certainly not ESG friendly.

Where Could We Be Wrong?

Some see investing in cryptocurrencies as a way to “hedge” against monetary regime change. Notably, the global monetary system does undergo fundamental shifts every so often. As recently as 1971, the value of the US dollar was fixed to the price of gold, and all other currencies were pegged to the US dollar. While it may seem like ancient history, less than 100 years ago all currencies were backed by gold or silver and the global reserve currency was the British pound, not the US dollar.

The economic and investment landscape does change. To proponents, the skepticism over the future adoption and utility of bitcoin and other cryptocurrencies simply reflects fear or ignorance by those who do not understand the technology behind them or in general are less at ease with technological change. Certainly much of the hype around bitcoin is over its use of blockchain technology for verification of transactions. And here we come to a crucial point.

Bitcoin Is Not “The Block Chain”

Proponents of cryptocurrencies argue that the utilization of blockchain technology has the potential to “disrupt” and revolutionize the traditional financial payments sector. We agree. However, investing in bitcoin is not the same thing as investing in blockchain technology.

Its possible use in a wide variety of applications—from financial services to health care to data security—suggests blockchain technology has the potential to generate financial returns for investors. Yet, a holder of bitcoin does not earn income or otherwise earn an economic return from the spread of blockchain technology. The only way holders of bitcoin profit is from further rises in the price of bitcoin, assuming there are more buyers.

China’s announcement that its central bank is developing its own blockchain-based virtual currency is a potential disruptor to the disruptors. Blockchain technology is largely open-sourced and thus nothing stops governments (or other entities, such as banks 9 ) from creating their own blockchain-based currencies with all of the advantages cited by cryptocurrency proponents, except perhaps anonymity. Said differently, while blockchain technology is innovative and appears set to spread across a number of sectors, bitcoin or any other cryptocurrency could lose relevance and disappear.

As a result, those considering holding cryptocurrencies should view them as akin to direct venture capital investments and size any such holdings as a venture fund would size a single investment. In other words, be just as prepared to write down the investment to zero as to mark it up to 100x.

Conclusion

In our opinion, much of the interest in cryptocurrencies is simply speculative, with more new entrants being drawn in by the allure of rapidly rising prices. History is full of such examples, from the Dutch Tulip mania of the 1600s to the Beanie Baby bubble of the late 1990s. 10 To consider cryptocurrencies as an investment, one has to assume they will continue to gain traction as an actual medium of exchange for everyday use. Further, investors must have confidence that whatever cryptocurrency they back (e.g., bitcoin) will remain among the future winners; history is also full of examples of initial leaders in a new technology that appear to dominate, only to then fall by the wayside.

Investors interested in cryptocurrencies need to think carefully about what they actually want exposure to. The risk/return profile for cryptocurrencies seems binary, given they have no economic source of return. Thus, any direct exposure needs to be sized accordingly, and investors must be able to tolerate the massive volatility and potential for permanent loss. In our view, investors looking to gain exposure to and potentially profit from the spread of blockchain technology or fintech more broadly are better off investing in companies developing these technologies, recognizing that such investments, which would generally be made through venture capital funds, are in their early days as well and also subject to a high degree of risk. 11

Aaron Costello, Managing Director

Daniel Day, Senior Investment Associate

Footnotes

- This paper will not cover the technology or the mechanics behind bitcoin and other cryptocurrencies. Bitcoin.org contains a very simple introduction as well as the original paper by Satoshi Nakamoto, “Bitcoin: A Peer-to-Peer Electronic Cash System,” November 2008, available at: https://bitcoin.org/bitcoin.pdf.

- Given the increasing amount of computing power required to “mine” additional coins, some analysts estimate that the full supply of coins may never be reached.

- Log scales help put price levels into context, as the distance between units is the same. For example, a move from $0.10 to $1.00 is the same percentage change as the move from $1.00 to $10.00.

- Specifically, there are currently two different types of bitcoins with two different prices: bitcoin classic (BTC) and bitcoin cash (BCH). The former trades at nearly $6,000, the latter at nearly $400. In November, bitcoin gold (BTG) and bitcoin segwit2x (B2X) are expected to come into existence.

- So much so that on July 25, 2017, the SEC released an investor bulletin warning about ICO risks and fraud available at: https://www.investor.gov/additional-resources/news-alerts/alerts-bulletins/investor-bulletin-initial-coin-offerings.

- The seminal piece on bubbles is Charles Kindleberger and Robert Aliber’s Manias, Panics, and Crashes: A History of Financial Crises (Hoboken, NJ: Wiley), first published in 1978, with a seventh edition published in 2015.

- For more details see Olga Kharif, “Hedge Funds Flip ICOs, Leaving Other Investors Holding the Bag,” Bloomberg.com, https://www.bloomberg.com/news/articles/2017-10-03/hedge-funds-flip-icos-leaving-other-investors-holding-the-bag.

- For more information on cryptocurrency fraud in China (and elsewhere) please see Tim Swanson, “Eight Things Cryptocurrency Enthusiasts Probably Won’t Tell You,” Great Wall of Numbers, http://www.ofnumbers.com/2017/09/21/eight-things-cryptocurrency-enthusiasts-probably-wont-tell-you/.

- In September the Financial Times reported that a consortium of Japanese banks will launch a virtual currency to reduce the use of physical cash in Japan. See Martin Arnold and Leo Lewis, “Japan’s Big Banks Plan Digital Currency Launch,” Financial Times, September 25, 2017.

- There are striking parallels between cryptocurrencies and Beanie Babies, a type of stuffed animal that became an object of speculation in the United States in the late 1990s. Issued in small batches, each new Beanie Baby was a limited edition with fixed supply. They became sought after by collectors, who began to trade them on eBay. This allowed for price discovery and fueled a speculative bubble that occurred alongside the broader 1990s Internet bubble. More than a hobby, Beanie Babies were touted as a store of wealth and an investment opportunity for those who had missed the early stages of the tech bubble, perhaps just as cryptocurrencies are being touted today. For an entertaining read on this topic, see Zac Bissonnette, The Great Beanie Baby Bubble (New York: Portfolio/Penguin, 2015).

- A report by CB Insights has found that blockchain start-ups fail at a higher rate than other start-ups in the technology sector. For more discussion on trends in blockchain investing, see CB Insights “Blockchain Investment Trends in Review,” https://www.cbinsights.com/research/report/blockchain-trends-opportunities/.