Case Study: Building custom portfolios to reflect each family member’s distinct impact investing goals

The Hahn family’s wealth, which originated in manufacturing four generations ago, is today overseen by Wilson, the current family patriarch, and supported by a family office staff of two investment professionals. The family members themselves have minimal investment experience.

CLIENT BRIEF

- Client: Hahn family

- Source of wealth: Manufacturing (inherited wealth)

- Situation: Family members with distinct and differing portfolio requirements

- CA relationship: Non-discretionary

The family’s assets were invested across four portfolios—one for the parents, one each for the two children, and one for the family foundation—and the respective “owners” had differing investment preferences, especially as related to Sustainable and Impact Investing (SII).[1] Given the family’s stature within its industry, investment opportunities often were presented to them, but many were not of institutional quality. Assessing them thoroughly was challenging for the family’s investment staff, a process made even more difficult by the varying portfolio interests of each family member.

One of the sons, Charlie, and his wife, Anne, were especially interested in incorporating SII into their portfolio. Charlie had previously met Melissa Jones, an investment director within Cambridge Associates’ (CA’s) SII team, and reached out to her to learn more about the firm’s capabilities.

CLIENT NEEDS

While Charlie and Anne’s environmental and social interests were the catalyst, the other family members joined the initial conversations with CA, as they recognized that their diverse needs were straining the resources of their family office.

Collectively, the family sought:

- Expertise in SII

- Access to institutional-quality investments and to experienced investment specialists across all asset classes who could source and thoroughly evaluate opportunities

- Ability to customize portfolios to reflect each underlying asset owner’s goals and priorities

- Ability to make and implement investment decisions in coordination with family office staff

SOLUTION

Melissa introduced the Hahn family and the family office to Jane, an investment director within CA’s Private Client Practice, so that, in addition to SII expertise, the family’s investment team included family investing experience. In discovery conversations with the Hahn family, Jane and her team learned about each family member’s goals. These input sessions included a full Family Enterprise Review, which enabled the CA team to gain a complete sense of the key issues that would inform investment policy setting and, later, implementation. This included reviewing the family financial ecosystem, long-term goals and intentions, spending needs and cash flow patterns, return objectives, risk and volatility guidelines, and tax and legal considerations.[2]

For the portfolios where SII would be incorporated, these intake sessions also included asking about each portfolio owner’s purpose, priorities, and principles—the “three Ps” CA employs to help define the why, what, and how of each investor’s unique SII portfolio. With Charlie and Anne, for example, this involved learning about their motivations, the values they wanted to advance through their investments, and their risk appetite and return objectives. Through these discussions, Charlie and Anne expressed their principle of avoiding investments that “harmed the world,” outlined their specific views on areas such as pharmaceuticals, animal testing, and sustainability, and expressed their return expectations. CA used this valuable input to formulate the couple’s investment strategy and policy framework and, subsequently, to identify specific investment opportunities. The parents, their second son, Brian, and the collective family on behalf of the foundation experienced a similar discovery process with CA. The family was impressed by CA’s Global Investment Research team—including its dedicated SII team of more than 12 professionals and its private investing team of more than 100 professionals—and the quality and depth of their manager due-diligence capabilities.

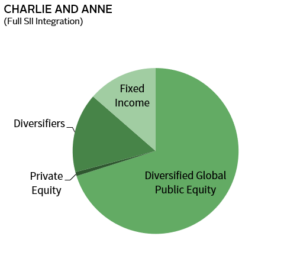

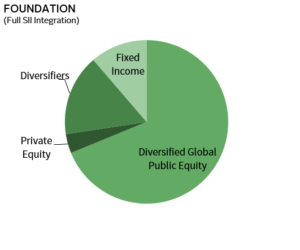

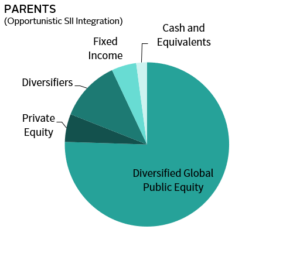

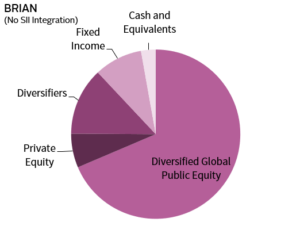

Following the discovery process, it was decided that Charlie and Anne’s portfolio, as well as that of the family foundation, would be managed as fully integrated SII portfolios. The parents’ portfolio would instead adopt an “opportunistic” approach of incorporating SII allocations when they appeared the most attractive, creating a hybrid portfolio within their non-SII portfolio. As Brian did not feel strongly about SII, he retained a diversified portfolio that intentionally did not incorporate SII.[3]

Over the next three years, the CA investment team worked to build out each of the family’s portfolios. The family office oversaw portfolio execution, given the non-discretionary relationship, so Jane and Melissa worked closely with them in sharing manager diligence and recommendations, as well as overall portfolio allocations.

Family Portfolio Asset Allocations

Ordered from most SII integration to least

For Illustrative Purposes Only

OUTCOME

Given the family office’s limited resources, Charlie, Anne, and Brian had thought that they would have to accept the parents’ approach to investing. Talking with CA made them realize that, with CA’s help, their individual preferences could be incorporated in their respective portfolios while all family members could benefit from the investment resources of CA’s global platform, and the Hahn family office could receive much-needed support.

The family is happy that each member’s preferences and goals are reflected in their individual portfolios, and that they are able to access high-quality investment opportunities that have been subject to detailed due diligence. Now that Charlie, Anne, and Brian feel they have more control and influence over their portfolio strategy, they have become more engaged in investing and more understanding of the decisions made for their individual portfolios. Through this process, the parents have gained confidence in their children’s investment knowledge and, thus, in their ability to steward the family’s wealth in the future.

This narrative has been fictionalized to ensure anonymity, but is based on actual client work.

[1] Sustainable and Impact Investing (SII) incorporates environmental, social, and governance (ESG) investments as well as impact investments.

[2] For more information on Cambridge Associates’ Family Enterprise Review, refer to Portfolio Construction: A Blueprint for Private Families.

[3] Note: Cambridge Associates’ global research and investment teams look at all investment opportunities through the lens of SII, not just for managers who have self-selected as ESG or Impact.