2026 Outlook: Private Equity & Venture Capital Views

Investors should revisit private portfolio exposures amid a morphing market in 2026

by Andrea Auerbach

While the last year has been one of recovery for the private markets, the aftershocks of the 2021 era continue to reverberate, with both the distribution drought and concomitant fundraising slowdown expected to extend their four-year runs into 2026. We believe the private markets have now troughed and the recovery phase is underway amid an evolving market structure that demands fresh thinking from institutional investors and sophisticated families.

Let’s start with the secondary market, which we believe will continue to develop in 2026. Why? Because in this extended distribution drought, investors from all sides have been taking liquidity matters into their own hands. Many limited partners (LPs) have entered the secondary market as first-time sellers and general partners (GPs) have expanded the use of continuation vehicles (CVs). In fact, CVs are estimated to represent at least 20% of distributions in 2026 as LPs overwhelmingly opt for the “sell” option rather than roll. Manufacturing liquidity is one reason secondaries transaction activity has hit an all-time high in 2025, and we expect this trend to continue into 2026. Secondaries activity makes up less than 5% of all private market activity, which leaves a lot of room for expansion. With a pattern of earlier distributions and an early return bump, secondaries are likely to become a base layer in private market portfolios to offset unexpected primary fund investment return (and cash flow) volatility like we have recently experienced.

Individual investor capital will continue to replace or augment institutional capital in 2026. The institutional fundraising drought, which troughed in 2025 at a mere one-third of 2021 volumes, may have even been an unwitting accelerant in efforts to open the private markets to individual investors through varying outlets—including fund investment platforms, evergreen funds, interval funds, and defined contribution or similar program inclusion—as managers seek to diversify away from institutional sources of capital. The emerging individual investor class is participating through vehicles that imperfectly overlap with institutional investor structures yet invest in the same securities. Investment outcomes and implications will continue to reveal themselves in the coming year, and institutional investors and sophisticated families could benefit from positioning exposures to benefit from this surge or, at the very least, be somewhat insulated based on where capital is being collected.

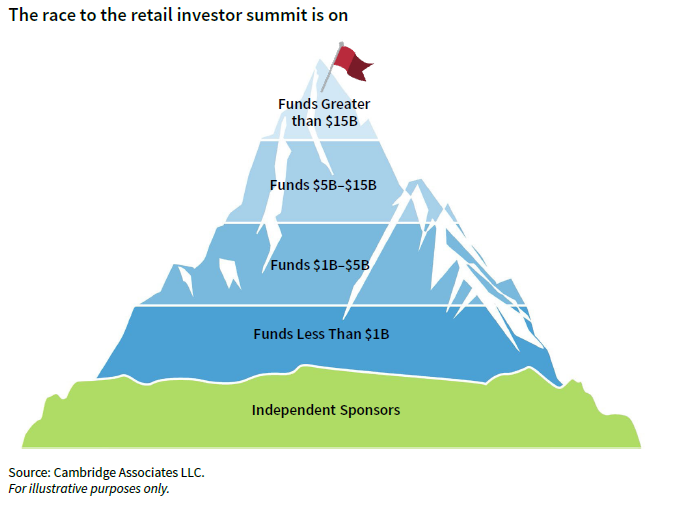

The rise of the individual investor is accelerating the market bifurcation we first observed in 2019. Mega-managers, namely those who have expanded, acquired, or partnered to offer a range of private market investment options, are best positioned to capture the flag in the race for retail capital. These mega-managers, many of which are publicly traded, may indeed amass the lion’s share of aggregate investor capital, and, as a consequence, their role in a private investment portfolio will likely morph into something different as they manage multiples more capital than the rest of the market; institutional investors and sophisticated families will need to rethink the megas’ role in portfolios.

By our estimate, the institutional private market is only in its fifth decade, and many of the changes and shifts echo the evolution of other investment markets, with much of the morphing happening in the upper elevations as fund sizes continue to climb. The key in 2026 is to begin to adapt to these changes in market structure. Actively consider the use of secondaries in a portfolio, determine how to invest advantageously around or into the individual investor wave, and tier private market exposure to capitalize on both return and diversification, given the concentration of returns in other markets.

Investors should moderate commitments to seed-focused venture capital strategies in 2026

by Zach Gaucher

Early-stage–oriented venture capital programs have historically delivered the asset class’s best risk-adjusted returns, and we expect that to continue. However, for most investors in 2026, we advocate for limiting new commitments to exceptional pre-seed and seed-stage–focused strategies, given the maturation of the seed asset class, heightened early-stage valuations, and the elevated bar to go public.

As has been clear for some time, venture is no longer a cottage industry. More than 4,200 venture funds have been raised in the United States since 2022, many of which are pre-seed and seed-stage funds with less than $100 million of committed capital, according to Pitchbook. Even as mega funds—those larger than $1.0 billion—make up 40% to 60% of the total commitments raised over the same time period according to Cambridge Associates, there continues to be a proliferation of smaller seed funds.

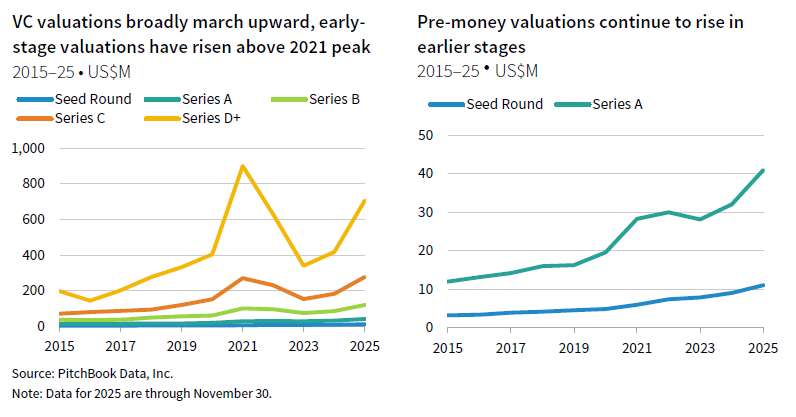

The growth of seed funds has helped to support a thriving ecosystem resulting in more than 5,000 seed stage rounds each year since 2022. 1 However, this activity—combined with larger, multi-stage firms moving into the ecosystem—has pressured valuations. While valuations are heightened across stages, seed valuations did not reset following the activity in 2020 and 2021 and have marched steadily upward.

The “private for longer” dynamic compounds the challenges facing current seed-stage investors. As average hold periods extend, and the bar to go public or achieve significant M&A becomes more elevated, winners may become rarer and more consequential for the asset class. Of note, in the 21 recent venture-backed technology IPOs we track, these companies had median last 12-month (LTM) revenue of $537 million, LTM revenue growth of 31.4% and scored 32.6% on the Rule of 40. 2 Of course, we would be remiss to ignore that the majority of realizations for the asset class have been driven by M&A, but a healthy IPO market is the barometer by which the asset class is often judged.

For a seed manager investing in ten to 20 companies per year, allocating to a company that will reach today’s IPO scale reflects an out of the money option, given the more than 5,000 inception stage rounds that have occurred annually in recent vintages. Even getting to Series A remains an uncertain endeavor—just 15.5% of seed companies funded in first quarter 2023 had raised a Series A as of first quarter 2025.

The industry’s Power Law dynamic, which denotes that a small percentage of outcomes carry the industry’s returns, continues to play out in real time. Indeed, according to Cambridge Associates data, nearly 90% of the asset class’s value has been driven by the top 10% of companies. With these odds, allocators should be judicious in manager selection—pre-revenue, AI-focused seed funds may capture the zeitgeist but may not capture the Power Law. Allocators should commit to only exceptional seed managers and recognize that many new funds have similar profiles, with GPs often having strong operating or founding experience or spinning out of established firms resulting in a highly competitive, if somewhat undifferentiated dynamic.

LPs should be mindful that “missing” the Power Law winners can result in a venture program that underperforms expectations. While we are cautious on seed funds today, they have a role in venture programs. In other words, investors would be best served by thoughtfully committing to funds across the spectrum of stages, particularly when exceptional opportunities exist. Doing that will increase the odds that LPs can capture Power Law winners that slip through the grasp of earlier-stage managers.

Footnotes

Andrea Auerbach - Andrea Auerbach is the Global Head of Private Investments and a Partner at Cambridge Associates.

Zach Gaucher - Zach Gaucher is a Managing Director at Cambridge Associates.

About Cambridge Associates

Cambridge Associates is a global investment firm with 50+ years of institutional investing experience. The firm aims to help pension plans, endowments & foundations, healthcare systems, and private clients achieve their investment goals and maximize their impact on the world. Cambridge Associates delivers a range of services, including outsourced CIO, non-discretionary portfolio management, staff extension and alternative asset class mandates. Contact us today.