The Work of a Lifetime: Spend-Down Funds

An increasing number of institutions and families are electing to spend down their assets during a limited time period. Why? Some causes—such as climate justice—feel urgent to donors and they respond with more immediate action. Other donors believe greater financial support today through a spend-down fund compounds their impact, leading to better outcomes in totality compared to providing limited support over a longer time horizon. Still other donors prefer spend-down funds because they wish to be personally involved with their philanthropic work rather than leaving heirs to guess at their intentions. Finally, some donors set up spend-down funds as an alternative to (or in some cases along with) building perpetual wealth through institutional vehicles like foundations or family trusts.

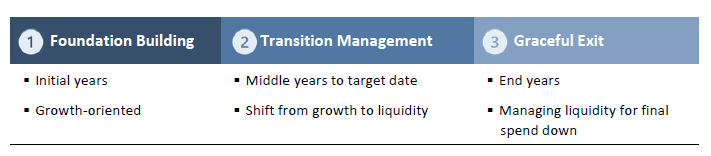

There are valid arguments for—and against—using spend-down funds to achieve philanthropic and investment goals. This paper provides historical context for spend-down funds, considers nuances for achieving good governance, and suggests an approach for dynamic asset allocation strategy, with case studies as illustrations. For spend-down investment strategy, we suggest a three-phase, adaptive approach, including:

While spend-down portfolios may seem radical to some investors, effectively turning the perpetual endowment model upside down, this approach—if executed well—can help institutions and individuals achieve the work of a lifetime.

History of Spend-Down Funds

The term “spend-down fund” refers to a time-limited investment pool, designed to spend capital faster than it generates capital through returns. In other words, spend-down funds are pools of assets that are designed to “spend down” to zero. Some have a specific end date (e.g., 2050), whereas others are variable (e.g., an estimated date based on the lifetime of the trustees or beneficiaries). Spend-down funds allow for a higher level of annual spending versus annual spending from a perpetual endowment pool; annual giving from a spend-down fund can be 10% or more, whereas perpetual endowment spending is generally in the 4% to 5% range, to maintain or grow purchasing power after spending and inflation.

Spend-down or “time-limited” charities are nearly as old as foundations in the United States. According to the Duke University’s Center for Strategic Philanthropy and Civil Society, there have been time-limited investment pools in the United States since 1890. Prominent examples include the Atlantic Philanthropies, the Bill & Melinda Gates Foundation, Conservation International, and the Diana, Princess of Wales Memorial Fund. There are also variations of spend-down funds, among the most notable of which is the Giving Pledge. Launched in 2010, its members—including Warren Buffett (Berkshire Hathaway)—have committed to giving away at least half of their wealth during their lifetimes. And spend-down funds are on the rise—a recent survey report from Rockefeller Philanthropy Advisors indicated that while perpetual models remain the most common, nearly a quarter of philanthropies established since 2000 have a time-limited model.

Beyond foundations and philanthropy, spend-down strategies are widely used for retirement planning, from target-date funds for individual retirement accounts to “glide paths” for institutional defined benefit portfolios, and for other institutional portfolios such as settlement trusts.

Spend Down Versus Perpetuity

Ultimately, the decision of which philanthropic path to take—spend-down funds or investing for perpetuity—is up to the investor. Making an assessment about the appropriate path involves consideration of a range of variables.

The Case for Spend-down Funds

- Some causes cannot wait. Climate change. Racial justice. Specific diseases. Gender discrimination. Economic development. While these challenges may not be solved in five years or even 50 years, there is a case that more support in the short term will serve to accelerate change, leading to greater total long-term impact and/or more impact at a faster rate in a critical time of need.

- Donor involvement/donor intent. Some wealth owners, including many who have been successful capital allocators in their business careers, prefer to be closely involved with their mission-related work and/or the institutions they support. Some also prefer to avoid the risk of “drift” in foundation priorities away from the donors’ original intent in decades to come. 1

- Avoiding dynastic wealth. Warren Buffett, in describing his choice to give away the majority of his wealth, famously recommended that wealthy families “leave the children enough so that they can do anything but not enough that they can do nothing.” 2

The Case for Investing for Perpetuity

- Maximum long-term spending. If investment portfolios can sustainably earn more than they spend, the amount of spending over time can far extend what a spend-down fund can achieve because of the compounding effect of investing over longer time horizons.

- Intergenerational equity. A central tenet of endowment-style investing is equity between future and present beneficiaries. Some causes and institutions will need support for decades and even centuries to come—the clearest example of this is education and schools, which benefit from endowments as a source of sustainable financial support.

- Time arbitrage in investing. Some investment strategies require a long time horizon or capacity to lock up capital to realize potential for higher returns. This includes public equities, where a minimum five- to ten-year time horizon is desired, given the inherent volatility of these strategies. This also holds true for alternative strategies like private equity and venture capital, where capital is locked-up for ten to 15 years.

Governance and Investment Strategy

Governance is Essential

While spend-down funds can be radically different from perpetual endowments and family trusts, one success factor is consistent: good results require good governance. This means setting clear policies and objectives, carefully curating who oversees investment and spending policies, separating governance and management of investment assets, and adhering to best practices for meetings and communications with constituents.

So, what is different about spend-down fund governance? A few things:

- Larger shifts in asset allocation. Significant and dynamic asset allocation changes should be expected with spend-down funds depending on which “phase” the fund is in (more on this below) or based on recent results and current market conditions. In contrast, for perpetual portfolios, major asset allocation shifts should be rare.

- Continuity of decision makers, if possible. While evolutions within the decision-making group (e.g., term limits, succession plans) are needed for perpetual portfolios, spend-down funds benefit from having largely the same people to the end, if possible. Doing so enables a spend-down fund to stay on course, given the many variables to evaluate and to ensure governance changes do not fundamentally disrupt or alter the purpose and reason for the spend-down fund’s creation.

- Closer coordination to enhance impact. Many investors are deepening links between their investment portfolios, missions, and values, which may include more coordination and communication between the teams overseeing investments and grants. For perpetual portfolios, there is often distinct separation between the investment and grant-making teams; for spend-down funds, coordination may be even more needed to ensure as much capital as possible (in investments as well as grants) is driving toward the same urgent causes and impact goals.

A Three-Phased Investment Strategy

While spend-down funds may have a target date to get to zero, in practice the investment strategy should be dynamic and adaptive. An investor may start with a clear plan spanning 15 years, for example, but capital markets may not always cooperate with that vision. It is important to have flexibility to adjust spending both up and down and to adjust asset allocation plans.

Our framework starts with liquidity management, working backward from the target end date. The goal is to ensure sufficient liquid assets to support a pre-determined number of years’ spending (i.e., minimum coverage ratio), and a buffer for additional years through lower-risk diversifying assets. Taking this approach also helps determine how much the portfolio can afford to invest in growth assets: in the early years, when spending needs are relatively low, more growth-seeking investments can be appropriate—including private equity and venture capital. Over the middle years, a keen eye on liquidity and spending coverage helps develop a transition plan to a more defensive portfolio, especially as the end years approach.

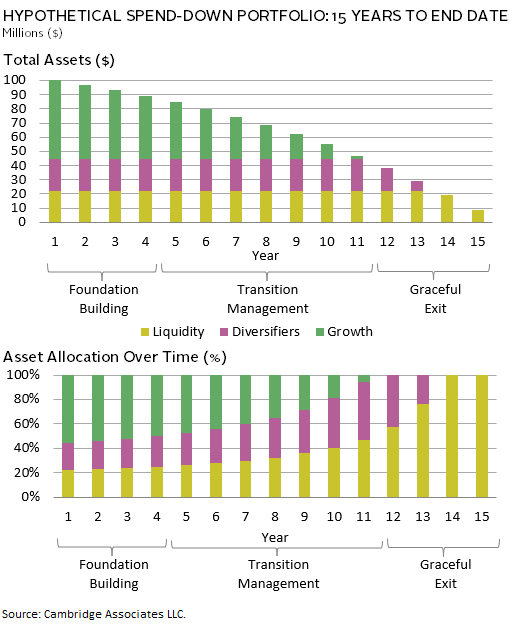

Case Study 1: Hypothetical Portfolio, 15 Years to End Date

$100 million initial value, no additional inflows, $11.1 million spending/year, total spend: $164 million.

Return assumptions: For simplicity, we assume consistent annual returns, of 10% for growth investments (e.g., public and private equities), 7% for diversifiers (e.g., hedge funds and private credit), and 3% for liquidity pool (e.g., cash and bonds).

Spending: We assume annual spending from the liquidity pool only, and annual rebalancing to have two years’ spending in the liquidity pool and an additional two years’ spending in diversifiers (if possible).

Results: What results is a steady decline in assets, but significant growth beyond merely spending down cash (total spending of $164 million, so 1.6+ times the initial $100 million pool value).

Observations: Notably, the asset allocation does not change in a straight line from growth to liquidity—rather, the aim is to seek the maximum possible growth allocation while maintaining sufficient liquidity to live through two to four years of market volatility.

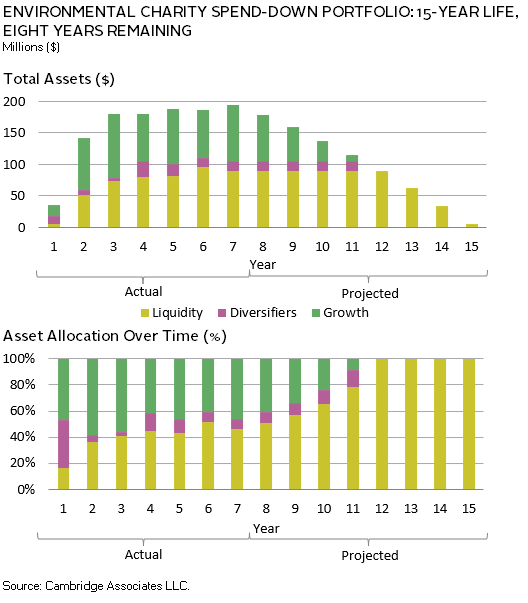

Case Study 2: Building Up and Spending Down. Environmental Charity, 15-Year Life, Eight Years Remaining

Initial Funding and Cash Flows: $300 million of inflows over the first five years, $194 million in outflows (grants) in Years 1–7, $245 million in additional grants anticipated through Year 15 (total of $439 million or 1.5 times contributions).

Asset Allocation: Started at 47% growth (public and private equity), 37% diversifiers, and 16% liquidity (short duration bonds), and adjusted dynamically over time. As of Year 8, approximately 40% growth and 60% diversifiers and liquidity.

Returns and Spending: Same return assumptions as for Case Study 1—10% for growth, 7% for diversifiers, and 3% for liquidity. Annual spending of $30 million from Years 7–14, with final remainder spent in year 15 (projected at $5 million).

Private Investments: Growth-oriented private commitments during Years 2–5 only.

Governance: Monthly meetings and frequent rebalancing.

Key Insights: Actual outcomes will never follow a straight line or perfectly align with plans. In this case, the institution and Cambridge Associates team adjusted to cash inflows at multiple points in the initial years, along with dynamic market conditions. Throughout this time, good governance and clear communication were critical.

From Theory to Practice: Embracing Complexity and Taking an Enterprise Perspective

Case Study 1 is a stylized model, and Case Study 2 is a simplified version of a real institution’s experience. In practice, capital market returns will be variable and cash flows (in and out) may not be so steady. Spend-down funds require regular assessments to ask: Are we on track to meet our risk and return objectives and initial spending plans? Could we spend more, or should we spend less? Are any additional inflows expected? Could we afford a one-time large spend to support a pressing need? How do we best weather through a significant market downturn? Should we consider tactical deviations from our strategic plan given current opportunities and valuations? What are the range of possible outcomes from here forward? Lots to discuss—all in good time, at regular and well-structured meetings!

Also thinking beyond the spend-down portfolio, as with all investment pools, a total enterprise perspective is required. In many cases, spend-down funds are just one part of a larger whole—for example, the institution highlighted in Case Study 2 has a perpetual endowment alongside the spend-down portfolio. And some Giving Pledge signatories may have permanent family capital alongside the more than 50% they plan to give away.

Linking Investments With Impact Goals?

While the focus of this paper is investment strategy and governance, there is much more to the picture—including fund-level implementation options and achieving goals beyond financial returns. For example, since the goal of spending down assets is to maximize positive impact over the life of the portfolio, it stands to reason that investors may seek to maximize the allocation to impact-oriented investments as well as philanthropy. Within the portfolio, investors could integrate environmental, social, and governance (ESG) factors as well as sustainable, diverse, and targeted market-rate impact investments. These could be combined with grants and investments with below-market risk-adjusted returns outside the portfolio, in order to both seek returns and achieve mission-related goals across the full spectrum of capital.

Conclusion

More investors are electing to spend down their assets rather than build perpetual portfolios. The spend-down approach comes with its own opportunities and challenges, but changing perceptions around philanthropy and a desire for more immediacy around potential impact is driving a new trend toward spend-down funds. Electing a spend-down fund approach, however, still requires a foundation of good governance. A structured but dynamic, multi-phased asset allocation strategy can help investors stay on the spend-down path, although stakeholders should expect and be able to adapt to twists and turns along the way. If executed well, spend-down portfolios may help investors effect greater change in the world.

Christoph O’Donnell, Managing Director, Endowments & Foundations

Margaret Chen, Global Head, Endowment & Foundation Practice

Sarah Edwards and Chris Parker also contributed to this publication.

Footnotes

- An additional risk sometimes cited is the lack of drift if priorities are “set in stone.” One example is if a foundation is dedicated to curing a disease that has since been cured.

- Warren E. Buffett, “Comments by Warren E. Buffett in Conjunction With His Annual Contribution of Berkshire Hathaway Shares to Five Foundations,” June 23, 2021, https://www.berkshirehathaway.com/news/jun2321.pdf.

Margaret Chen - Margaret Chen is the Global Head of the Endowment & Foundation Practice at Cambridge Associates.

Christoph O’Donnell, CFA - Christoph O’Donnell is a Managing Director for the Endowment & Foundation Practice at Cambridge Associates.