Rising inflation and moderating growth are generally associated with a higher risk premium as investors start to price in a potential shift in market regime. In the past, global macro managers have generally benefited from better alpha opportunities that arise from volatility. With this backdrop, we expect macro hedge fund performance to be better than average next year.

Because macro hedge funds do not take explicit market risk, have a flexible mandate in which they can go long or short, and can access a wide variety of instruments, managers tend to generate returns that are uncorrelated to major markets. By not relying on the direction of markets, macro managers must count on alpha to generate attractive risk-adjusted returns.

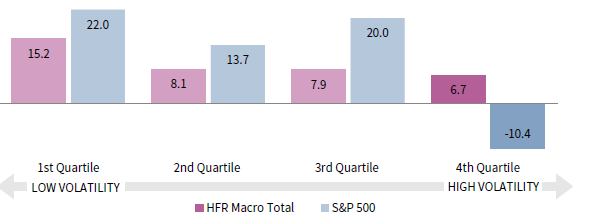

While a volatile market may not be friendly to most investment strategies, having pockets of volatility to exploit can be advantageous to global macro. In fact, the average macro strategy has traditionally outperformed equities by a large margin when markets were most volatile. Of course, the dispersion of hedge fund returns is wide, so any given hedge fund could look much different than the average.

Interestingly, the data show that global macro can do well in low volatility regimes too, with an S&P 500 upside capture of nearly 50%. Rather than a portfolio “insurance,” macro is thus more of a diversifier that is expected to be up across all regimes. We believe this return characteristic is partially due to the flexible approach that allows macro managers to nimbly reverse course when the market proves them wrong, particularly when the size of assets is not an impediment for moving nimbly.

Global macro strategy is likely to profit from uncertainties ahead. Still, that does not mean managers in this space can only outperform in an adverse scenario.

AVERAGE MACRO STRATEGY HAS OUTPERFORMED EQUITIES IN VOLATILE MARKETS

First Quarter 1990 – Third Quarter 2021 • AACR of Quarterly Performance by VIX Quartiles (%)

Sources: Chicago Board Options Exchange, Hedge Fund Research, Inc., Standard & Poor’s, and Thomson Reuters Datastream.

Notes: Returns are net, except for first quarter 1990 to fourth quarter 1998 for S&P 500 where gross returns are used due to lack of data. Hedge Fund Research data are preliminary for the preceding five months.

Meisan Lim, Senior Investment Director, Hedge Funds