Building Resilient Portfolios: Liquid Diversifiers for Today’s Institutional Challenges

What does it take to build a resilient portfolio in a world where market shocks, regulatory shifts, and geopolitical tensions are the new normal? For many institutions—such as Defined Benefit plans, Insurance organizations, Nuclear Decommissioning Trusts, and others—the challenge is twofold: achieving viable diversification and ensuring sufficient liquidity to rebalance portfolios and meet disbursement requirements. While hedge funds have historically played a key role in portfolio diversification, their semi-liquid nature has prompted some investors to seek new solutions. As asset structures and strategies continue to evolve, liquid diversifiers represent a modern approach to portfolio construction, offering the potential for uncorrelated returns, improved liquidity, and enhanced risk management.

The last two decades have tested the resolve of many investors. During the Global Financial Crisis and the COVID-19 pandemic, traditional portfolios of stocks and bonds proved moderately resilient to market shocks. The Federal Reserve hiking cycle in 2022 exposed many vulnerabilities in these traditional portfolios, as high inflation drove correlations between stocks and bonds higher, reducing their diversification benefits. Many portfolios, once heavily reliant on equities and core fixed income, have found themselves overexposed to market swings and underprepared for liquidity needs. The current market environment could be described as anything but normal, and future shock events may continue to break the traditional fold.

Hedge funds provide meaningful diversification and downside protection, and, in many cases, still represent an important role in portfolios. However, their less liquid nature and higher fees have diminished their appeal, particularly for asset pools with ongoing cash outflow needs. For investors with near-term capital requirements, the delayed liquidity of hedge funds is a significant drawback. Capital typically takes three or more months to withdraw, which is impractical if rebalancing or if a portfolio outflow is needed at the end of the current month. As a result, investors are increasingly adding liquid diversifiers to their asset mix—strategies and assets that combine the diversification benefits of alternatives with the liquidity profile of public markets. Liquid diversifiers could represent a standalone allocation or in many cases be used in conjunction with traditional hedge fund portfolios.

So, what exactly are liquid diversifiers? In simple terms, these are assets or strategies that can be sold within a month or less, while offering returns that are uncorrelated with traditional equities, bonds, and alternatives such as hedge funds. Liquid diversifiers are not meant to replicate hedge funds strategies, but instead focus on market opportunities to complement institutional portfolios. There is a wide range of strategies that fit this description, but in general these can vary from:

- Traditional strategies: high-yield bonds, REITs, and inflation-sensitive assets.

- Niche strategies: insurance-linked securities (ILS), currency strategies, and structured liquid credit.

The goal is to build a portfolio that not only reduces reliance on equities and fixed income but also addresses specific risks—such as inflation spikes or credit events—that can lead to asset erosion and asset/liability mismatches.

Portfolio construction principles

Constructing a liquid diversifier portfolio requires both art and science, tailored to each pool’s risk tolerance, liquidity needs, and objectives. Key principles include:

- Beta Management: Most liquid diversifiers have a lower beta (0.0 to 0.3), similar to diversified hedge fund portfolios, which provides meaningful diversification from equity risk.

- Fixed Income Management: Traditional fixed income ranges from core (Agg) holdings for many institutional portfolios to longer duration holdings for defined benefit pension plans. Regardless of investor type, the focus is similar—high-quality, fixed-rate bonds. Liquid diversifiers, on the other hand, should focus on floating rates with relatively shorter duration and idiosyncratic credit risk.

- Inflation Sensitivity: Inflation risk remains a concern for asset allocators, as high inflationary environments increase correlations between equities and bonds, resulting in depressed assets in traditional equity and bond portfolios. Diversifying assets with inflation sensitivity—such as commodities or energy-related securities—can help protect portfolio values in these periods. They come at a cost, as these assets traditionally underperform other asset classes over time, so careful strategy selection and sizing is necessary.

- Manager Selection: Superior manager selection and dynamic asset allocation are critical to achieving the desired risk/return profile, particularly as many of the liquid diversifying assets are actively managed.

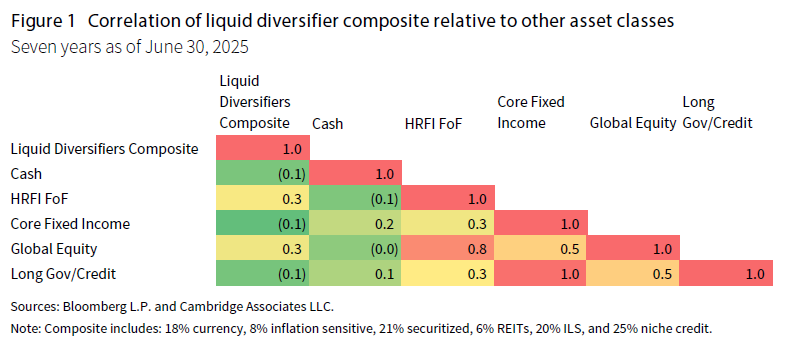

Combining these various objectives can lead to a robust strategy and fund mix, leading to valuable diversification benefits. An important consideration is to find managers and strategies that not only exhibit low correlation to traditional assets, but also each other—meaning positive returns come at different periods. When one strategy performance is down, another one’s may be up. In practice, these managers would be combined at varying weights, resulting in a diversified composite with favorable diversification relative to other asset classes in the portfolio.

As Figure 1 shows, the composite portfolio results in low correlation to other commonly used asset classes. Most notably, the composite allocation shows only a 0.3 correlation with global equity and near 0.0 correlation to fixed income. To compare, the HFRI Fund of Funds Index, a traditional diversifying asset, shows 0.8 and 0.3 correlations to global equity and fixed income, respectively. A lower correlation implies the liquid diversifier composite mix provided a more diversified return pattern relative to broad hedge funds. We would be remiss not to mention that an HFRI benchmark is non-investable and exhibits certain biases, such as survivorship.

Performance and risk

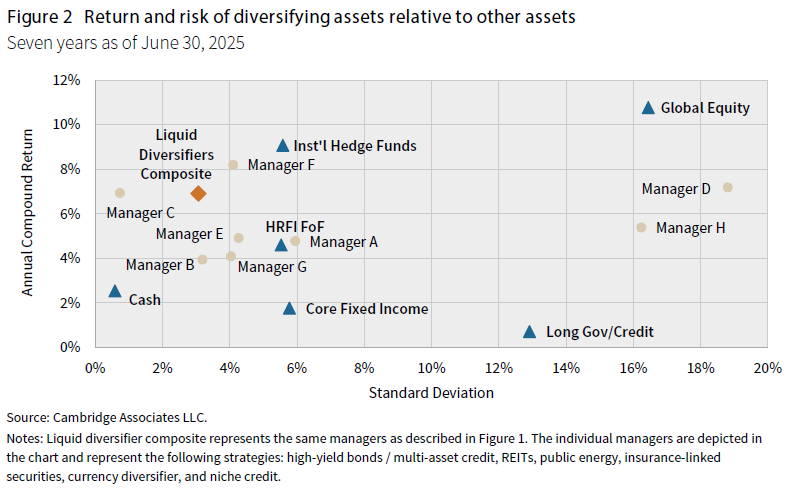

With clear diversification benefits intact, what can investors expect from a well-constructed liquid diversifier portfolio? Ideally, diversifier allocations would deliver returns between those of bonds and equities, with lower volatility and the potential to outperform traditional hedge fund indexes. Performance over the prior seven years shows something even more remarkable, as depicted by Figure 2.

The individual diversifying managers have varied performance in terms of both risk and return. In general, most have outperformed traditional fixed income assets, and many, the hedge fund composite. Most notably, the sample liquid diversifiers composite was able to outperform most every manager in terms of return efficiency (Sharpe ratio)—generating one of the highest risk-adjusted returns. We have also reflected the median performance from hedge funds we deem as institutional quality (Inst’l Hedge Funds) to provide a more appropriate indication of performance from funds that commonly make it into institutional portfolios. This aims to alleviate some biases from the HFRI Fund of Funds Index, which, as mentioned, is uninvestable.

The main reasons for liquid diversifier outperformance include:

- Low Correlation: Liquid diversifiers can reduce overall portfolio risk by providing returns that are less correlated with core asset classes.

- Downside Protection: In periods of equity or bond market stress, certain diversifiers (e.g., catastrophe bonds, currency strategies) have demonstrated resilience.

- High Yields: Many of these strategies are income-generating and hold yields much higher than traditional fixed income. This is typically achieved through securitization or through niche markets, such as asset-backed finance.

- Floating Rate Structure: The low duration nature of these assets helps diversify from traditional, fixed-rate fixed income, which provides superior returns, especially during inflationary environments.

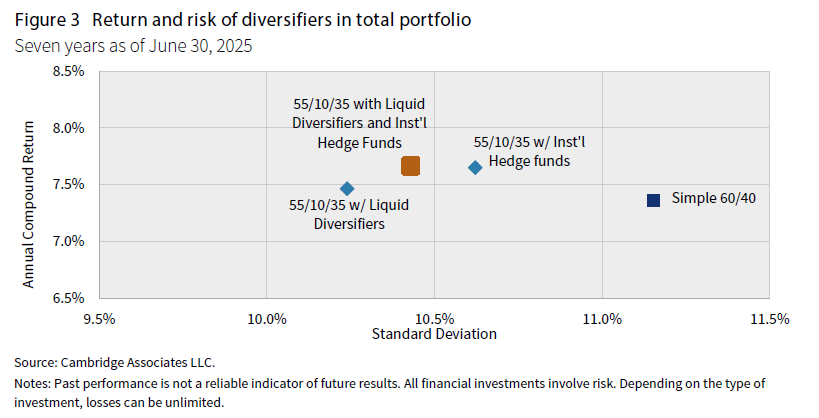

It should come as no surprise that inclusion of diversification in the portfolio should result in improved risk and return metrics. One way to illustrate these benefits is to model the inclusion of diversifiers into a generic 60/40 portfolio (60% global equities and 40% core fixed income). Since diversifiers represent the intersection between these two asset classes, the diversified portfolio could be defined as 55/10/35 (with 10% now representing diversifiers). As illustrated in Figure 3, the addition of diversifiers not only improves risk metrics, but also the return profile.

Including liquid diversifiers in the portfolio reduced overall risk by 90 basis points, while also increasing returns. This analysis also supports the approach of using high-quality hedge funds and liquid diversifiers to achieve overall portfolio diversification, with hedge funds providing slightly higher returns for slightly higher risk. In practice, both allocations could be used to achieve the highest risk-adjusted allocation, as shown by the orange square. Of course, manager selection is as crucial as ever.

Implementation considerations

In today’s volatile and ever-changing investment environment, designing an investment strategy, monitoring its effectiveness, and altering it when appropriate is challenging. In addition, implementing a liquid diversifier strategy requires careful attention to benchmarking, fees, and operational considerations, such as:

- Benchmarking: Selecting an appropriate benchmark is challenging. Options include the HFRI index, beta approximations, or a blended approach tailored to the specific mix of diversifiers. The latter is typically used in practice, blending the benchmark of each diversifier manager.

- Fees: Most liquid diversifier strategies are actively managed, which tends to increase the management fees of the funds. Leveraging economies of scale and strong manager relationships can help reduce these fees. Regardless, the composite fees are generally lower than those of traditional hedge funds.

- Governance: Clear guidelines for manager selection, monitoring, and rebalancing are essential for success and need to be reflected in any Investment Policy Statement.

Conclusion

In a world where uncertainty is the only constant, investors with capital outflows can embrace new tools to achieve their goals. Liquid diversifiers offer a compelling solution—combining the diversification benefits of alternatives with the liquidity and transparency of public markets. By thoughtfully integrating these strategies, sponsors can build more resilient portfolios, better manage risk, and improve outcomes for beneficiaries. The future of investing is not just about weathering the next storm—it’s about building a portfolio that thrives in any environment.

Serge Agres, CFA, FSA, EA - Serge Agres is a Managing Director and Investment Actuary at Cambridge Associates.

About Cambridge Associates

Cambridge Associates is a global investment firm with 50+ years of institutional investing experience. The firm aims to help pension plans, endowments & foundations, healthcare systems, and private clients achieve their investment goals and maximize their impact on the world. Cambridge Associates delivers a range of services, including outsourced CIO, non-discretionary portfolio management, staff extension and alternative asset class mandates. Contact us today.