Higher Endowment Spending Needed for Some in Challenging Environment

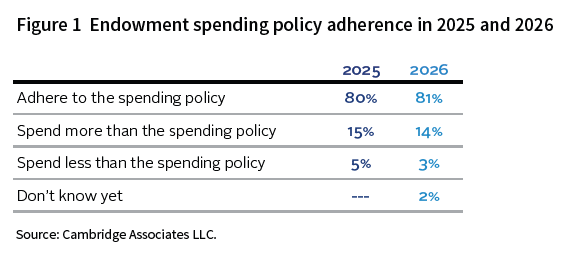

A recent Cambridge Associates survey of 104 endowments and foundations reveals that most institutions are adhering to their endowment spending policies, with 80% following policy in 2025 and 81% expected to do so in 2026. However, a notable minority—15% in 2025 and 14% anticipating in 2026—are spending beyond policy, primarily due to federal funding cuts and operating stress (Figure 1). Colleges, universities, and foundations are drawing more from their endowments to balance budgets, fund capital projects, and offset reductions in government support. The survey responses highlight that the evolving political environment is influencing spending decisions and underscoring that nonprofit organizations need strong communication and adaptive financial strategies.

Some institutions expect to spend more than policy

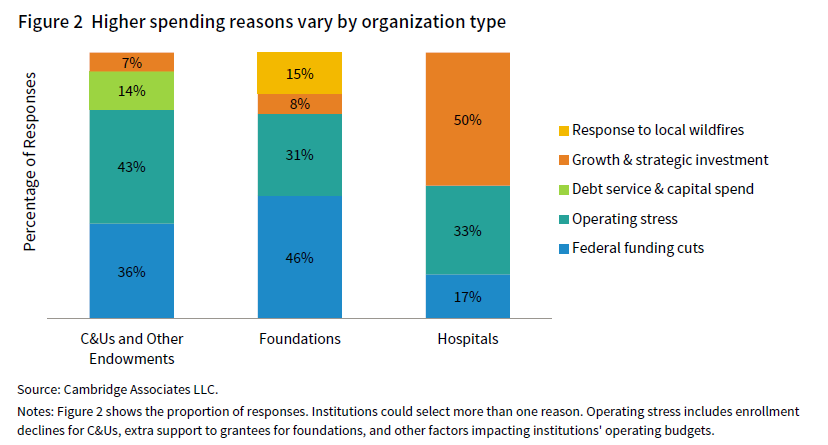

The institutions that expect to draw more from endowments (14%) cite that federal funding cuts and operating stress are driving most spending increases. Colleges and universities are spending more in response to financial stress that requires endowment funding to balance the operating budget. Several universities are taking additional endowment draws to fund capital projects or to pay debt service. Foundations are spending more than typical policy to replace some of the federal funding cuts. While a few hospitals are spending more because of operating stress and interruptions in government funding, more reported spending draws from their long-term investment portfolios (LTIP) to fund growth initiatives and investments in strategic plans.

Other themes also emerged in the survey responses.

- The seven colleges and universities that spent more in 2025 are private institutions. Six of the higher spending institutions expect to continue to spend beyond policy in 2026.

- There is only one public university among the eight schools that anticipate spending more in 2026. It is a public research university that is increasing spending in response to federal cuts to research and other funding.

- Five of eight hospitals distribute spending from their long-term portfolio at least once a year. Four of the hospitals (50%) have a formal spending policy for their long-term investment portfolio LTIP.

- More than a quarter of foundations surveyed spent more in 2025 and nearly one-third (30%) intend to spend beyond policy in 2026.

Governance matters

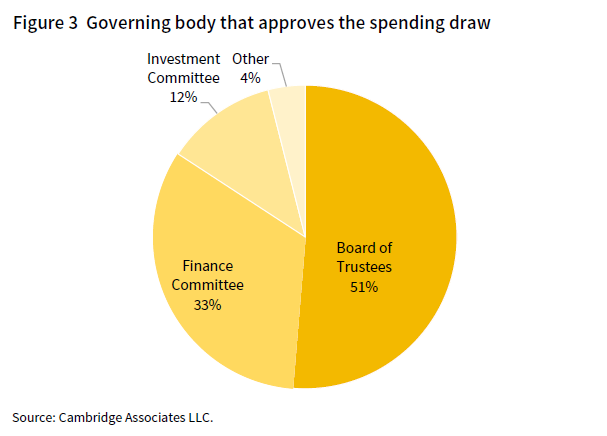

The full board of trustees is responsible for determining the level of spending at more than half of the endowments and foundations surveyed and the finance committee decides at nearly one-third. The investment committee controls the spending decision at only 12% of the organizations, which means that strong communication is needed among stakeholders to make sure that endowment spending and investment policy decisions are closely linked.

The political environment has disrupted nonprofit funding sources and operations in 2025, and this is expected to continue in 2026. Given the dynamic funding and operating environment, liquidity needs and risk tolerance can change if higher endowment spending is needed to balance budgets, fund capital, and seed growth.

Tracy Filosa - Tracy is a Managing Director and Head of CA Institute.

About Cambridge Associates

Cambridge Associates is a global investment firm with 50+ years of institutional investing experience. The firm aims to help pension plans, endowments & foundations, healthcare systems, and private clients achieve their investment goals and maximize their impact on the world. Cambridge Associates delivers a range of services, including outsourced CIO, non-discretionary portfolio management, staff extension and alternative asset class mandates. Contact us today.