Advancing Healthcare Missions with Disciplined Spending

The new tax bill passed by Congress and signed into law in early July will have a financial impact on all healthcare systems and may require funds to be pulled from systems’ long-term investment pools (LTIPs). The recent federal Medicaid funding cuts will create financial challenges for healthcare systems, particularly those with high Medicaid exposure. Some systems may be forced to pull from the LTIP to support operations. For those systems that find themselves in that situation, we recommend a methodical approach to spending policy (such as a defined rate of withdrawal that may be based on market value or predictable dollars needed). This piece outlines the expected impacts, key questions for decision makers, and analysis supporting a disciplined spending approach.

There are many variables around when and how the Medicaid cuts will play out. Some of the pain for these new provisions in the bill may take a few years to fully impact healthcare systems income statements, particularly those financially strong systems with more commercial payors and financial flexibility. Some systems’ leadership think that the longer time horizon in these provisions will allow them time to negotiate with lawmakers to alter the current plans. Also, states may be called upon to fill in gaps in revenue, so systems located in states with stronger financial positions may weather the storm better. Because these developments are likely to impact each healthcare system differently, decision makers overseeing assets should discuss how they expect to be impacted, what this bill might mean for funds needed from the LTIP.

Questions that systems should be asking to help inform whether any action is needed might include:

- How do you envision this bill impacting margins and forward expectations?

- Do the forward expectations of margins create a need for spending draws from the LTIP? Have liquidity needs within the LTIP changed?

- Would having a methodical spending policy, rather than ad hoc draws, be a better approach to support operations?

If there is some likelihood that operations might draw from the LTIP, it is prudent to at least consider creating a spending policy, if one is not already in place. This piece reviews the long-term implications of pulling funds at an ad hoc basis versus creating a spend policy.

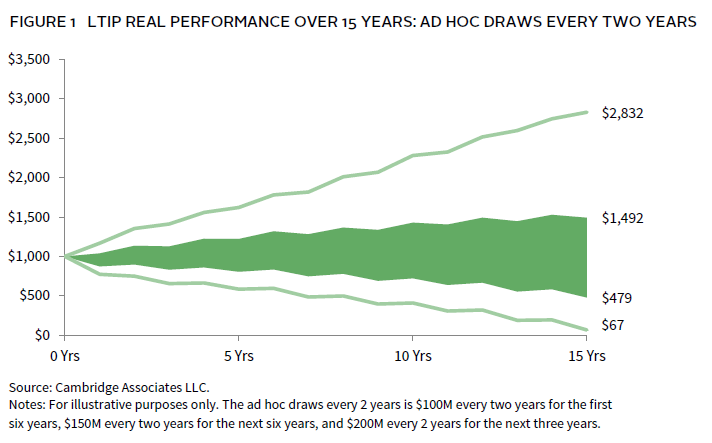

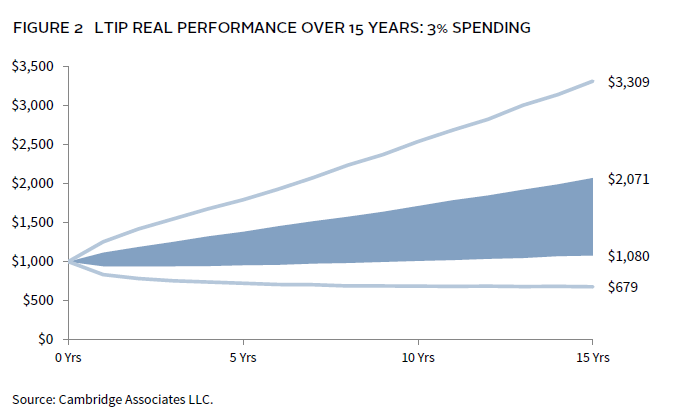

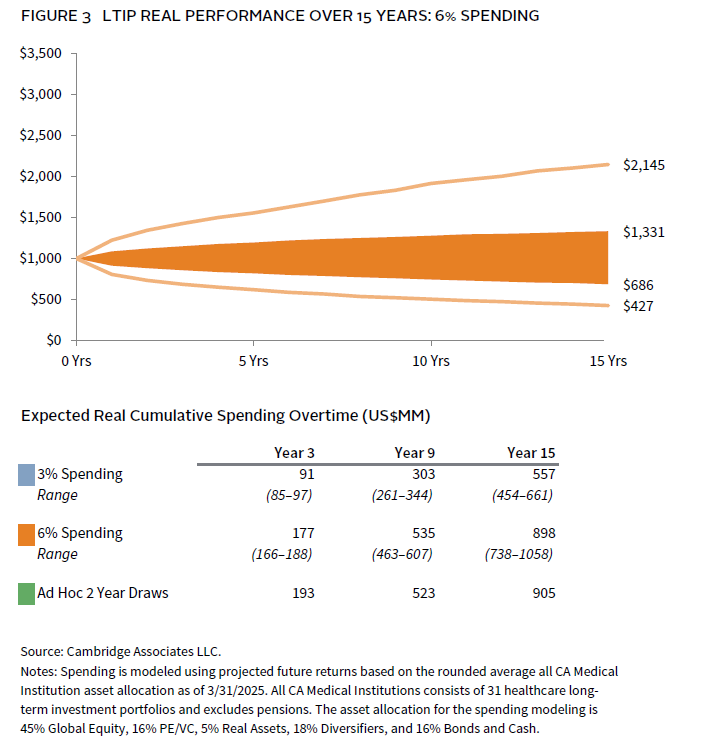

To test the hypothesis that a spending policy would have benefits to the long-term size of the LTIP versus ad hoc spending, we modeled how a $1 billion LTIP could perform over 15 years comparing three different scenarios: 1) ad hoc $100 million to $200 million outflows every two years, 2) 3% per annum spending, and 3) 6% per annum spending.

As seen in Figure 1, if those ad hoc draws every two years occur during periods of poor market returns, the LTIP could be spent down. The lowest line on Figure 1 simulates the lowest 5% probability return profile. The range of returns within 25%–75% probabilities is also very wide if we draw funds out ad hoc.

We next simulated long-term market values and dollars available to draw if a $1 billion LTIP used either a 3% per annum spend policy or 6% spend policy. Clearly the smaller draws of 3% shown in Figure 2 benefit the long-term size of the LTIP, but the 6% spend also allows for sizable long-term funds (Figure 3). Interestingly, the midpoint of cumulative spending at the 6% rate is similar to the ad hoc spending, though it has a less volatile range of final LTIP size and funds spent.

A disciplined LTIP spending policy—as opposed to ad hoc capital draws—better enables investment staff to plan and execute a long-term investment approach that more effectively supports the mission of a healthcare institution.

Bridget Sproles, CFA - Bridget Sproles is Co-Head of the Healthcare Practice and a Partner at Cambridge Associates.

About Cambridge Associates

Cambridge Associates is a global investment firm with 50+ years of institutional investing experience. The firm aims to help pension plans, endowments & foundations, healthcare systems, and private clients achieve their investment goals and maximize their impact on the world. Cambridge Associates delivers a range of services, including outsourced CIO, non-discretionary portfolio management, staff extension and alternative asset class mandates. Contact us today.